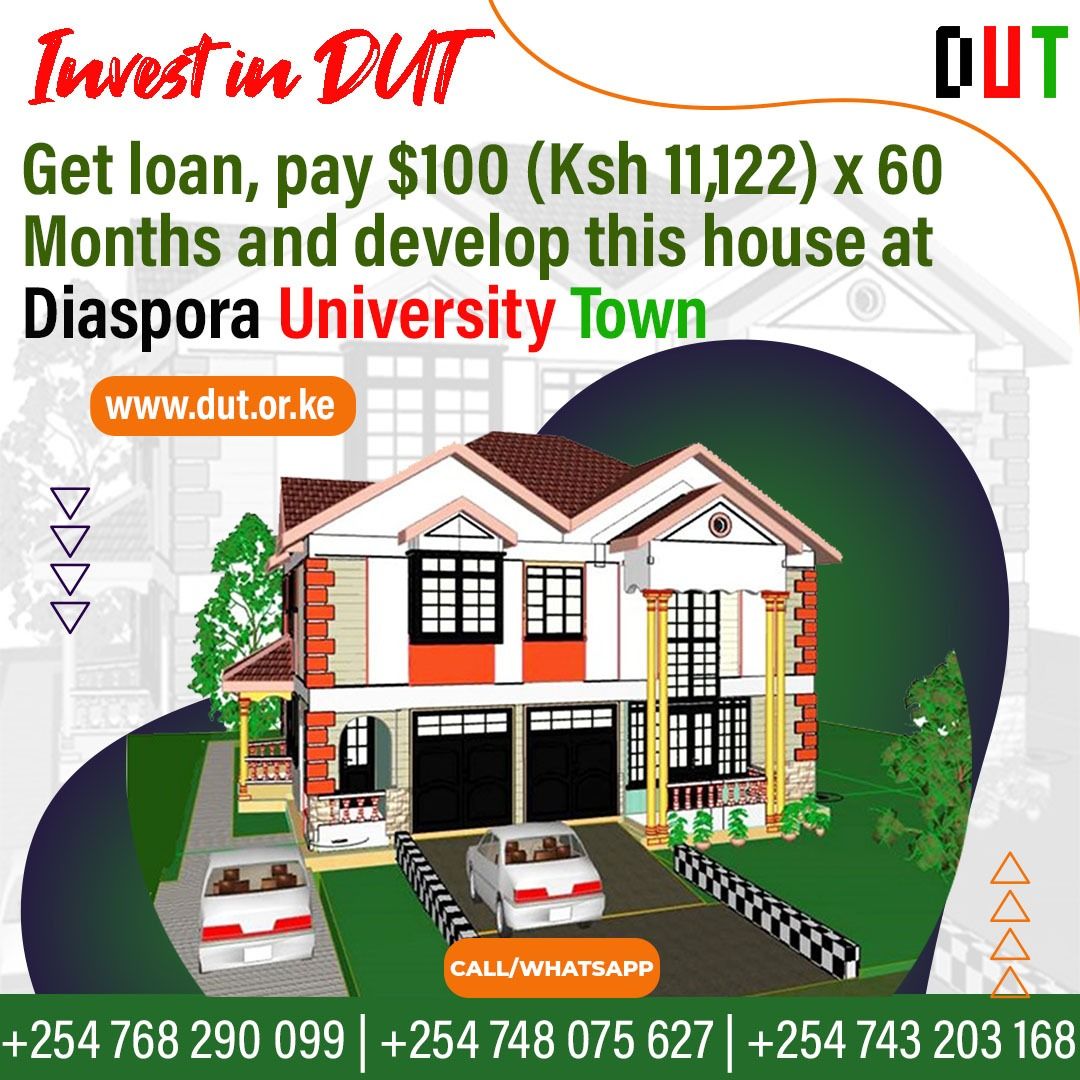

Diaspora Kenyans developers of the Diaspora University Town continue to progress DUT Credit Ltd in Kenya to become the Diaspora Bank. The financial institution is currently implementing the Diaspora University Town (DUT) finance plan. This is a plan that is expected to grow Kenya's banking sector by Kshs 100 billion and loan advances by Kshs 70 billion as the DUT development plan of 20,000 jobs creation, 7,000 properties development and 500 MSMEs opening is achieved.

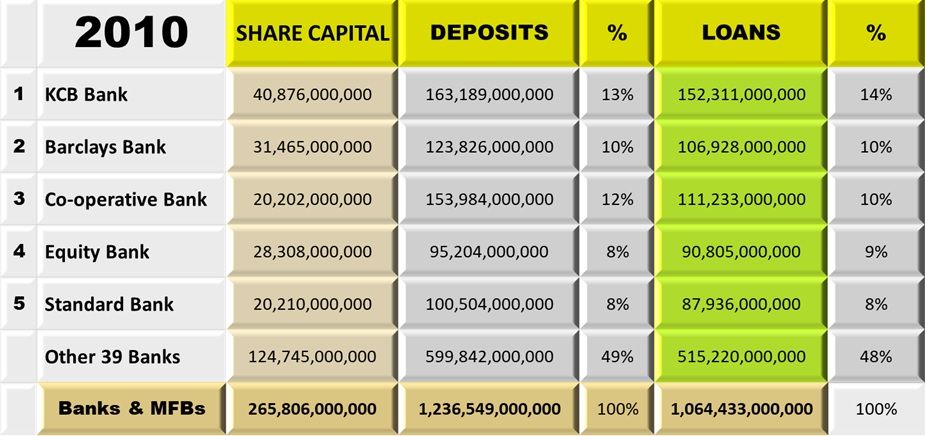

In 2010 Kenya banking sector had total deposits of Kshs 1.2 trillion. The loans advanced were Kshs 1 trillion. The 5 top banks (KCB Bank, Barclays, Co-operative, Equity and Standard) had 51% market of deposits and 52% market for loans advances. KCB Bank that traces its roots to 1896 had the largest share of deposits and loan advances.

From 2011 to 2021, in 11 years, the Kenya bank deposits would grow to Kshs 4.6 trillion. This averages to a growth of 13% per year. The loans advance would also grow to Kshs 3.2 trillion, a growth of Kshs 2.2 trillion. Equity Bank started in 1984 would in 2021 surpass KCB Bank as the bank with the most deposits at Kshs 652 billion. KCB bank at Kshs 634 billion.

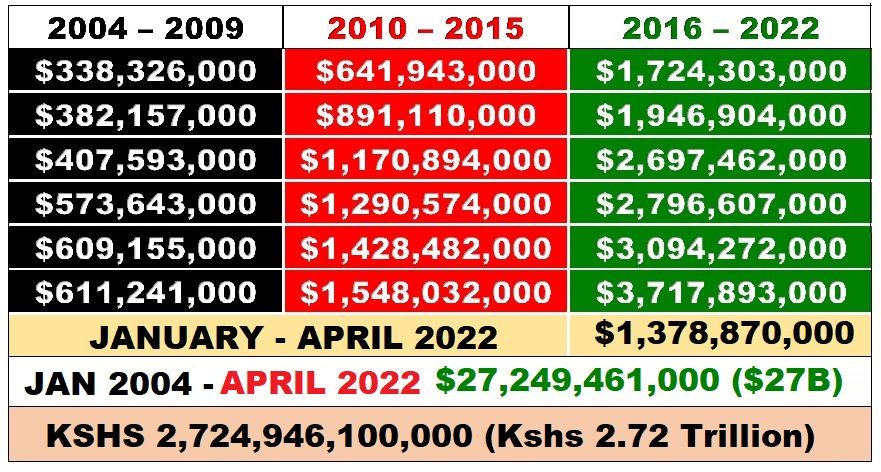

The idea of the Diaspora Bank started based on remittances. According to Central Bank of Kenya (CBK) reports from January 2004 to April 2022 the Diaspora remitted $27.2 billion about Kshs 2.7 trillion. This money has contributed to the growth of the Kenya bank deposits to Kshs 4.6 trillion.

As DUT Credit Ltd implements the finance plan of the Diaspora University Town (DUT) system of jobs creation and housing development it will grow to a bank.

DUT Credit Ltd will make the Diaspora Kenyans resource of intellect and cash. Currently the Diaspora Kenyans have vast intellectual resources that can make Kenya a developed country. The Diaspora has the resource of money as reflected by the Diaspora remittances. By 2030 Diaspora are projected to remit about $40 billion (Kshs 4 trillion)

The Diaspora intellect and cash resources will through the DUT Credit Ltd make Kenya land productive. Kenya is made up of land of 581,000 square kilometers. This is about 145 million acres of land. The Kenya land resource has all the components that once made productive will progressively meet the needs of food, housing, healthcare and other rights.

The Diaspora intellect and cash resources will through the DUT Credit Ltd make the Kenya human resource that at any given day is made up of the millions of Kenyans aged 18 – 65 years who can work and be productive. Currently Kenya has a human resource of about 26 million persons. At an average of 2,000 hours a year this is a resource of 52 billion hours. Valued at an average of Kshs 500 this is a resource of Kshs 26 trillion.

Land, Human Resource and finance resources contribute to the development of a country. The U.S finance system has made resources of land, human and finance productive and established 4,231 commercial banks with $22.2 trillion total assets for the 350 million population. Just like in Kenya, the top five banks had 52% of the market in 2021.

As the U.S banking system supports jobs creation and housing development, the system has enabled land and human resources to produce and meet the needs of food, housing, healthcare, energy, clean water, clean environment, education, and other needs.

DUT Credit will support jobs creation and make the resources of Diaspora, Land and human, productive to meet the Kenyan needs especially the needs of food, housing and healthcare.