The Central Bank of Kenya (CBK) banking supervision report of 2021 shows the total Kenya banking deposits of 53 financial institutions at the end of 2021 at Kshs 4.6 trillion. The report shows the banking sector investment in 39 banks and 14 microfinance banks at Kshs 902 billion. The report shows the loans advanced at the close of 2021 as Kshs 3.295 trillion.

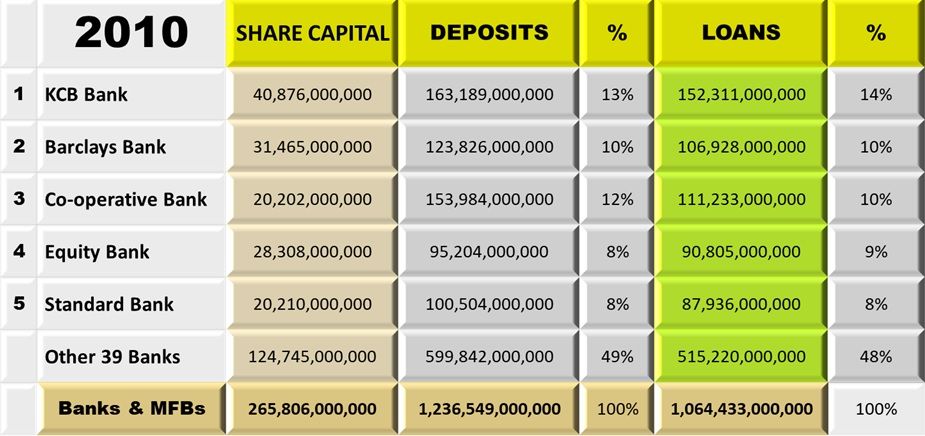

Kenya bank deposits and loan advances trace their roots to the opening of what is today KCB Bank in 1896. The CBK banking supervision report at the end of 2010 showed the deposits to have grown to Kshs 1.23 trillion as Kenya's population grew to about 39 million by 2010.

The Deposits growth in the last 11 years have increased from Kshs 1.2 trillion to Kshs 4.6 trillion, about four times. The loans have increased alongside the deposits, growing from 1.064 trillion in 2010 to 3.295 trillion in 2021. The total share capital in the banking sector increased from Kshs 265 billion to 902 billion.

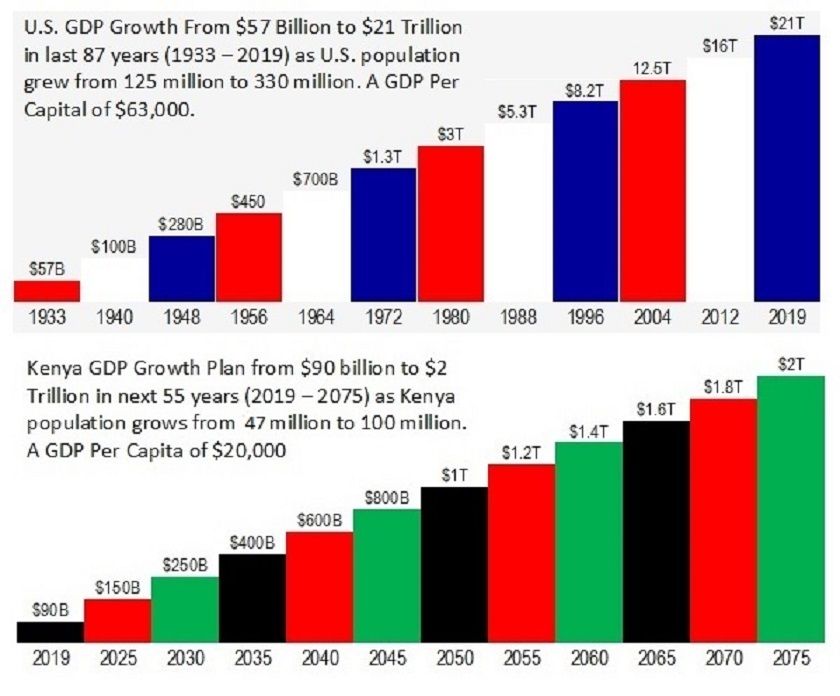

The growth of the banking sector 2011 - 2021 did not grow the Kenya Gross Domestic Product (GDP) at the same rate of growth like the banking deposits growth. The deposits growth from Kshs 1.2 trillion to Kshs 4.6 trillion averages to a growth of 13% every year for 11 years.

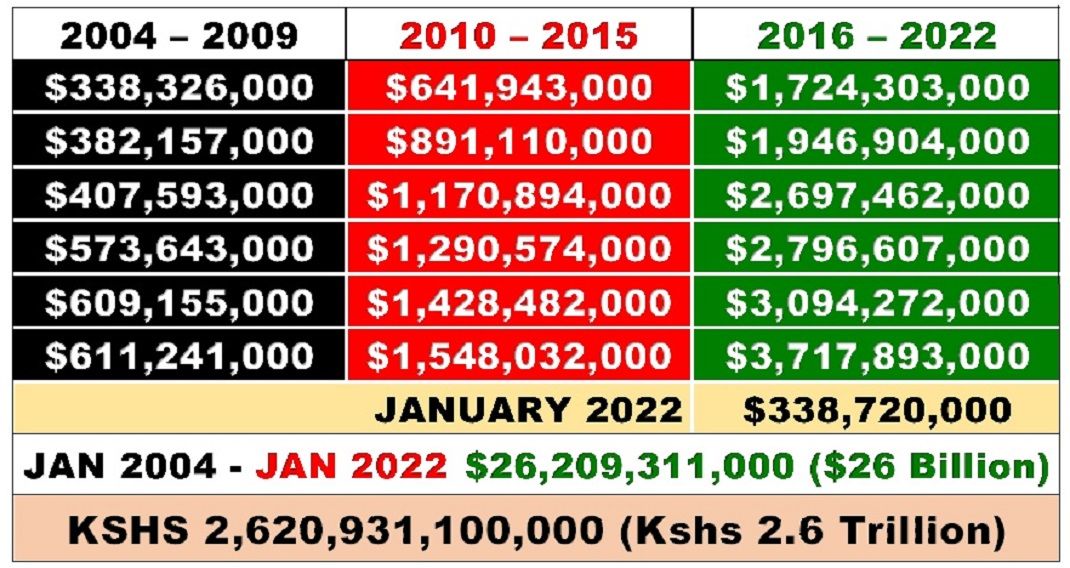

Diaspora Remittances in the period from January 2010 to December 2021 total to $22.3 billion dollars, this is about Kshs 2 trillion. The remittances contributed to the growth of deposits and loans. The remittances failed to influence the growth of Kenya GDP.

Diaspora Kenyans and Ndara B Community, through the Diaspora University Town (DUT) project have started a new finance institution with a goal to have banking deposits grow GDP and support jobs creation. The banking deposits and loans will support jobs creation systems and plans and enable persons and communities to achieve healthcare, environment and housing rights.

Through jobs creation and housing development systems, Kenya deposits can grow and surpass the Kshs 20 trillion mark by 2030. The loans would grow alongside the deposits and surpass the Kshs 16 trillion mark. The largest percent of the Kshs 13 trillion loan growth would be loans averaging about Kshs 5 million that would be taken by about 2 million Kenyans who get jobs and take a home mortgage loan. The 2 million new jobs, 2 million houses and the Kshs 10 trillion mortgages issued would give the right of housing to 10 million Kenyans of whom 6 million would be children.

Unlike the 2010 - 2021 period that had deposits growth driven from Diaspora Remittances; the new deposits 2022 - 2030 will be driven by the productivity of Kenya human resource and land resource using similar systems and plans that enabled the U.S grow to a $23 trillion GDP and a per capita income of over $60,000.

Diaspora Kenyans at an average of $4 billion a year are projected to remit about $40 billion, about Kshs 4 trillion in next 9 years, by 2030. The Diaspora remittances will grow deposits and the share capital in the banking sector. The banking sector share capital projected growth will be from Kshs 900 billion share capital to about Kshs 1.5 trillion.

Unlike the banking deposits that could grow five times, the banking share capital will grow at lower rate as banking services of safes, counters, bank visits, paper loan application and other services are provided through the electronic systems. The capital input to support the new deposits and loans will decrease and increase the return on capital.

(Dan Kamau, formerly of Worcester, MA, is the Diaspora University Trust – Executive Trustee www.dut.or.ke and a Director in DUT Credit Ltd www.dutcredit.co.ke. Dan can be reached via Email dan@dut.or.ke)