Dan Kamau lived in Worcester, MA. During his stay in the U.S he would become one of the founders of the Kenya University Project that is today the Diaspora University Town (DUT). At the project land, he has opened offices and is implementing the multi-billion project in Taita Taveta County. He says the project has an opportunity to grow any bank in Kenya with Ksh 50 billion deposits and Ksh 45 billion loan advances in the next 5 years as Diaspora Kenyans remit $20 billion (about Ksh 3 trillion) to Kenya.

Dan answered several questions.

How will DUT grow a Bank Deposits by Ksh 50 Billion & Loan Advances by Ksh 45 Billion?

Bank Deposits result from the three resources of production: land, human resource and money.

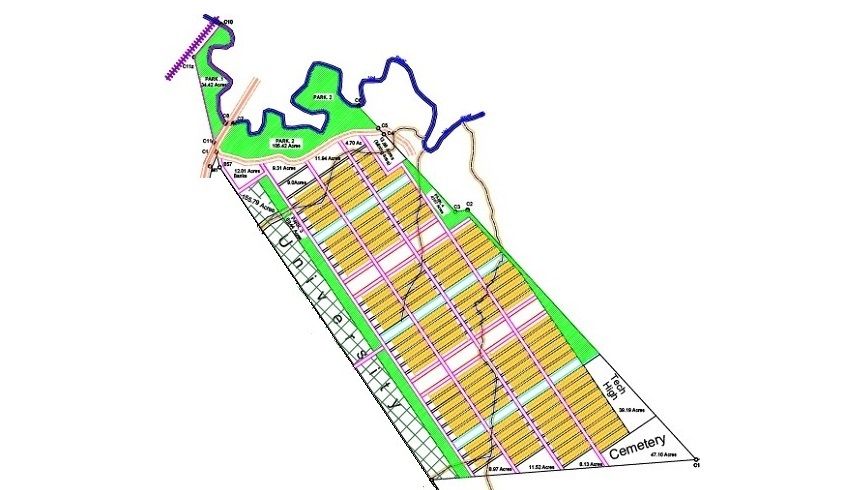

Diaspora University Town has a land of 1,500 acres held by Diaspora University Trust. The DUT land usage plan of 3,778 plots has valued the land through the plots and created over Ksh 5 billion in new capital. This new capital will progressively grow the deposits in the banking sector.

The DUT 15,000 jobs creation plan will lead to 100 million hours of human resource applied productively. As the hours are applied in the project, the banking deposits will grow by about Ksh 25 billion in 5 years.

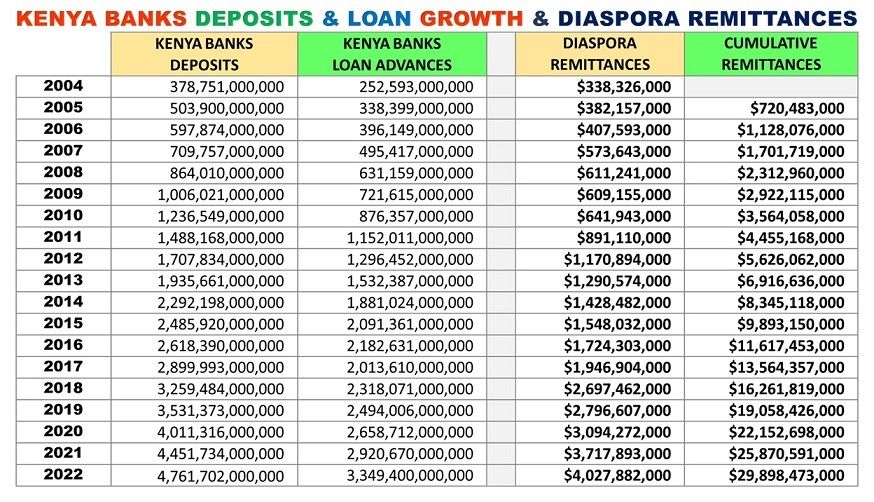

Diaspora Kenyans since 2004 have remitted $29 billion about Ksh 3 trillion. During the same period the total Kenya banking deposits have grown from Ksh 378 billion (2004) to Ksh 4.76 trillion (2022.)

The DUT plan implementation will lead to about $500 million (2.5%) of the projected $20 billion remittances, in the next 5 years, coming through the bank working with DUT. The bank deposits will grow.

The total deposits growth will be over Ksh 50 billion. The loan advances will grow as the bank issues the Trust, DUT individuals, and MSMEs take up individual, property and business loans of about Ksh 45 billion.

How does Banking help in the growth of an economy?

Banking grows the economy through the supply of the money resource.

Money was created so as to facilitate the land and human resource productivity in order to meet human needs. When the right systems of land and human resource productivity are applied the bank assets grow.

The growth of banking assets records the growth of an economy. The biggest banking asset is the loan advances that result from deposits.

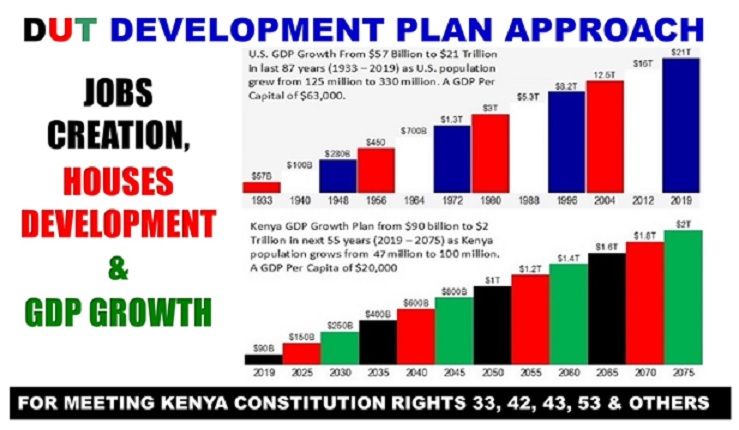

How does Kenya Banking Assets compare to the U.S Banking Assets?

As of March 31, 2023, there were 4,096 commercial banks and 576 savings and loan associations in the U.S. insured by the Federal Deposit Insurance Corporation (FDIC) with US$23.7 trillion in assets. The $23.7 trillion divided by the 350 million population in the U.S gives a figure of $67,700 per person.

The Central Bank of Kenya banking supervisory report showed that at the close of December 2022 there were 39 banks with total assets of Ksh 6.02 trillion and 14 microfinance banks with total assets of Ksh 70 billion. This totals to 53 banks with total assets of Ksh 6.1 trillion. Factored based on an exchange rate of Ksh 100 to the dollar. The assets valuation in dollars would be $61 billion. The $61 billion divided by the 52 million Kenyans gives a figure of $1,173 per person.

The $1,173 compared to the $67,700 shows the comparison of the Kenya Banks to U.S banks assets per individual. The figure also shows the role of banking in the development of the economy to sustain its population.

Why is the Banking Assets per Person High in the U.S and low in Kenya?

The banking assets are high per person in the U.S for the banking supports land and human resource productivity to grow GDP.

The banking assets are low per person in Kenya for the banking professionals in the banking sector in Kenya do not know how the GDP growth approach works.

As DUT makes 1,500 acres and 15,000 persons human resource productivity through GDP growth systems, the banking assets will grow by over Ksh 50 billion.

Which Bank is DUT looking to work with?

The bank that wants to grow its deposits by Ksh 50 billion and loan advances by Ksh 45 billion.

The Central Bank of Kenya (CBK) banking report of 2022 recorded 14 of the 39 licensed banks in Kenya, with less than Ksh 20 billion deposits. DUT would be happy to work with one of these banks.

Why should be Bank consider?

In 2007 Diaspora Kenyans sparked the growth of Equity Bank. The bank financial records in 2006 showed the Bank deposits at Ksh 16.3 billion. The bank in March 2007 came to the Diaspora and the Diaspora opened accounts and started making deposits in the Bank. By the close of 2007 the deposits of the bank had grown to Ksh 31.5 billion. The bank’s deposits doubled in one year. Diaspora Remittances in 2007 were $573 million.

Diaspora remittances have reached $4 billion an year and one dollar is exchanging above Ksh 140.

What would you tell a bank CEO who reads this?

$20 billion will be remitted by the Diaspora in the next 5 years. If you want $500 million to come through your bank and grow deposits and loan advances then reach out to DUT.

I also want to add that the DUT plan will not just grow deposits and loans; it will make land and human resources productive as it enables Kenyans to achieve their rights of food, housing, healthcare and other rights through their resources.

Dan Kamau can be reached by Email through dan@dut.or.ke

Read more on DUT at www.dut.or.ke