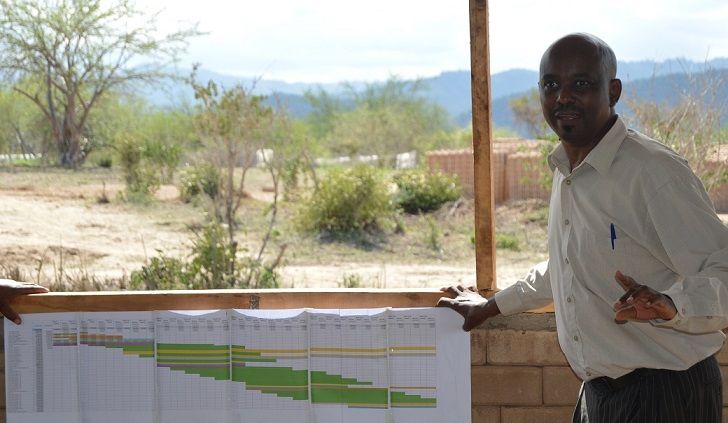

My name is Dan Kamau. I lived in Worcester, MA, U.S. I wrote the book, “Gambling with Destiny.” I started the Diaspora Kenya's online and print magazine, “Jamhuri Magazine.” I joined the WPI U.S – Africa Business Conference organizing committee. I established the Master Development Plan for university and town development. I’m currently at the Diaspora University Town (DUT) implementing the Master Development Plan (MDP) as the Diaspora University Trust (DUT), Executive Trustee and the Diaspora University Town (DUT), project director. Today I can tell my fellow Diaspora Kenyans that they have an opportunity to create two Jobs and develop a townhouse by putting in $100 a month at DUT.

When the WPI Business School Dean Emeritus, Prof. Michael Ginzberg, who I started working with in 2015, held two meetings last week, he talked to Diaspora and gave the example of how 225 Worcester Citizens and workers of 20 factories/Machine shops founded the WPI University and progressed Worcester city development and jobs creation. The professor asked that Diaspora Kenyans living in Worcester join and become founders of Diaspora University as they invest in developing the planned DUT properties and MSMEs.

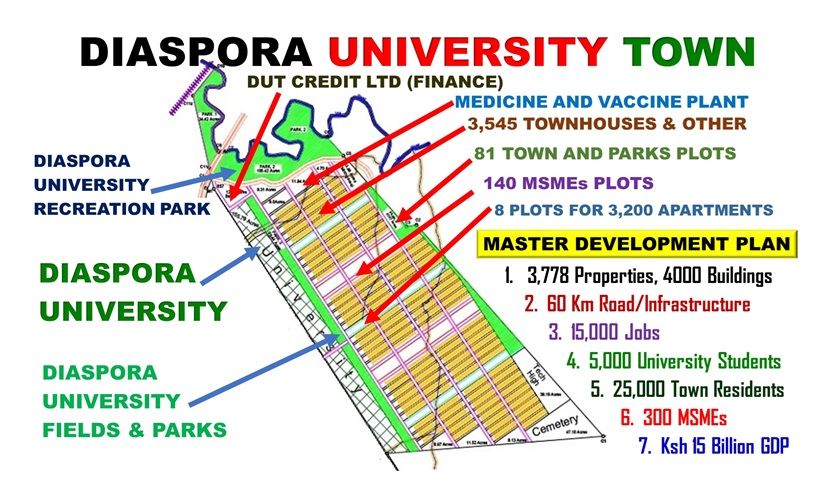

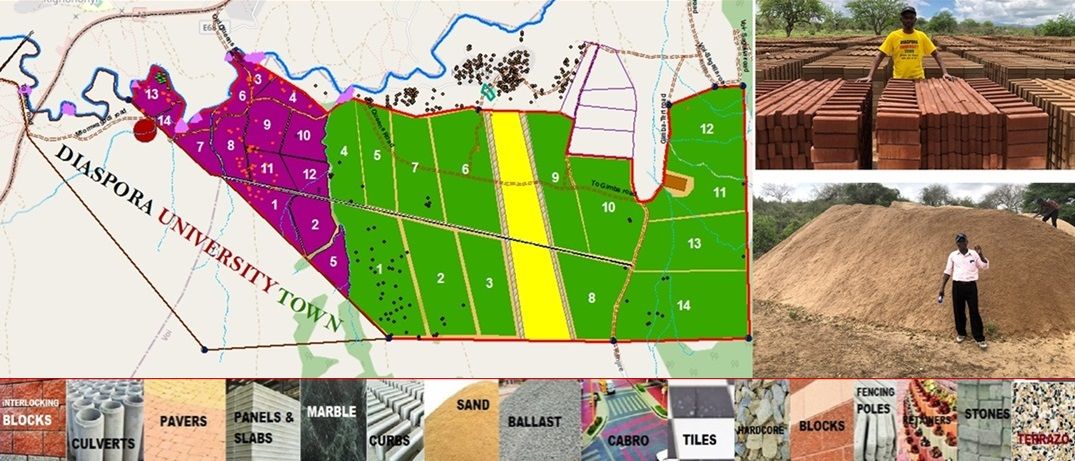

Diaspora University and Diaspora University Town founding is based on five resources. The first resource is WPI Plan from WPI University that started the idea during the 2006 WPI U.S-Africa business conference. The second resource is the Master Development Plan that was achieved in 2009. The third resource is the land of 1,500 acres that was achieved in 2017. The fourth resource is 2,000 Diaspora Kenyans founders as property and MSMEs Investors and developers. The fifth resource is the finance to be established from banks and financial institutions.

The resource of 2000 Diaspora Kenyans was calculated and incorporated when the Master Development Plan was established. This was based on the fact that Banks lend based on the ability to pay and Diaspora Kenyans have that ability through the economies they make income from. To discuss this resource, I and the late Prof. Raphael Njoroge held meetings with Diaspora Kenyans in diverse cities that included: Worcester, MA; Lowell, MA; Raleigh, NC; Atlanta, GA; Houston, TX; Dallas, TX and Kansas, KS/MO.

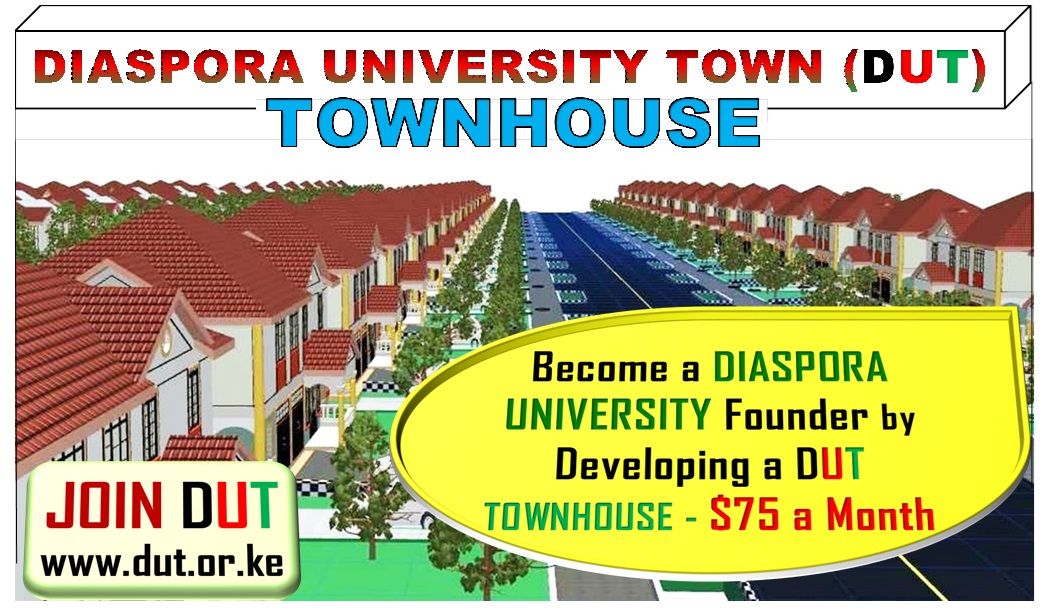

2000 Diaspora Kenyans investing $100 a month when developing at least a unit of the 3,500 town houses and investing in a unit/s of the Daktari Biotechnology 10,000 investments of Ksh 200,000 will collectively put in $200,000 (about Ksh 28 million) a month. The fifth resource will be achieved as the finance lending requirements of business plan, land and borrower's ability to repay will be met. The $200,000 (Ksh 28 million) input will be able to anchor a borrowing of about 50 times or $10 million (about Ksh 1.4 billion).

The $10 million (about Ksh 1.4 billion) will be a construction loan applied in the DUT design – build plan. In the first 52 weeks, 150,000 square meters made up of 583 buildings (574 Townhouses, 5 MSMEs buildings, 3 University, 1 Town) will be produced. The production budget is Ksh 4.5 billion. This production will be through 42 contracts and production plans.

During the 52 weeks production different properties will be completed at different weeks. Once property is completed, the property house development costs will be issued a mortgage in Kenya or the Diaspora Kenyan property developer/owner can pay off. The mortgages or cash payments budgeted will be redeposited into the construction account. The difference between 5 billion and 4.5 billion, Ksh 500 million is budgeted for loan interest and the Diaspora University Trust developer’s costs.

To answer the question of how $100 will create two jobs? The design-build plan shall create 2,000 jobs with Ksh 1.5 billion of the Ksh 4.5 billion budget applied to pay the 2000 workers. The materials production and supply from Ndara B 14 industrial companies shall create 1,500 jobs as they produce and supply materials of Ksh 1.5 billion in the Ksh 4.5 billion budget. Another 1,000 jobs will be created from the other Ksh 1.5 billion design-build budget and the approximate Ksh 500 million from the monthly remittances of at least Ksh 28 million. The 4,500 jobs created at DUT and Ndara B industries divided by 2000 Diaspora Kenyans investors are the 2 jobs created by the $100 remitted every month.

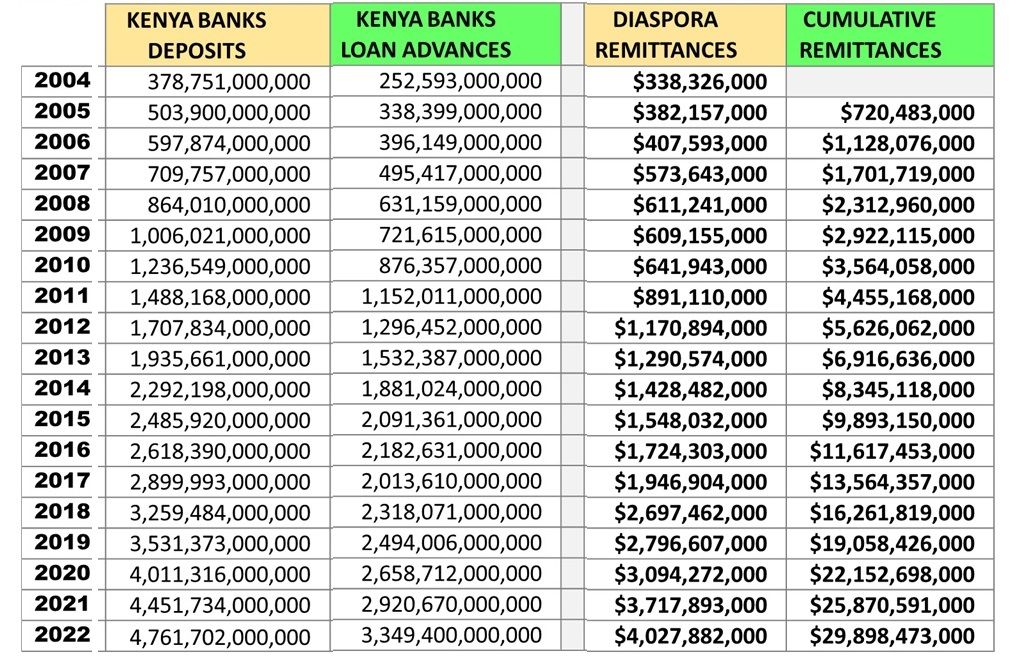

Mortgage finance comes from the growth of banking. Kenya banking has grown from Ksh 378 million to Ksh 4 .7 trillion from 2004 to 2022 with one of the key reasons for the growth being the $29 billion remittances during the same period. When deposits grow, the loans also grow as banks lend so as to pay deposit interest, operation expenses and investors returns.

Dan Kamau Email dan@dut.or.ke WhatsApp +254 743 203 168