Canada's top 5 banks in assets are reported as follows: Royal Bank of Canada, $1.7 trillion; Toronto-Dominion Bank, $1.5 trillion; Bank of Nova Scotia, $1.2 trillion; Bank of Montreal, $976 billion; Canadian Imperial Bank of Commerce, $763 billion. The total assets: of the 5 banks, $6 trillion. The total banking assets of Kenyan banks, as reported in the Kenya Banking report of 2023, were Ksh 7.7 trillion (about $70 billion). The question of why the total assets of the 5 Canadian banks are at $6 trillion while all Kenyan banks are at $70 billion was part of the discussion at a Diaspora University Town (DUT) meeting between DUT founders, Ndara B Community and KCB Bank officers.

The productivity of three resources—land, human resources, and money—is what grows the bank assets. These resources, when productive, give individuals and families the rights to food, housing, healthcare, education, clean water, a clean environment, children's rights, and other rights.

Canada's population of about 40 million is today getting these rights every day through the productivity of these three resources. The productivity of these resources is reflected in the $6 trillion total assets of just five banks.

Kenya's population of about 52 million is not getting all of the rights because the three resources are not producing the rights. Land resource productivity through natural products is not being achieved. Human resources of about 26 million Kenyans are not producing to capacity. The money resource for facilitating the productivity of the land and human resources is not growing as fast as reflected by the low total bank assets of Kenya when compared to a country like Canada.

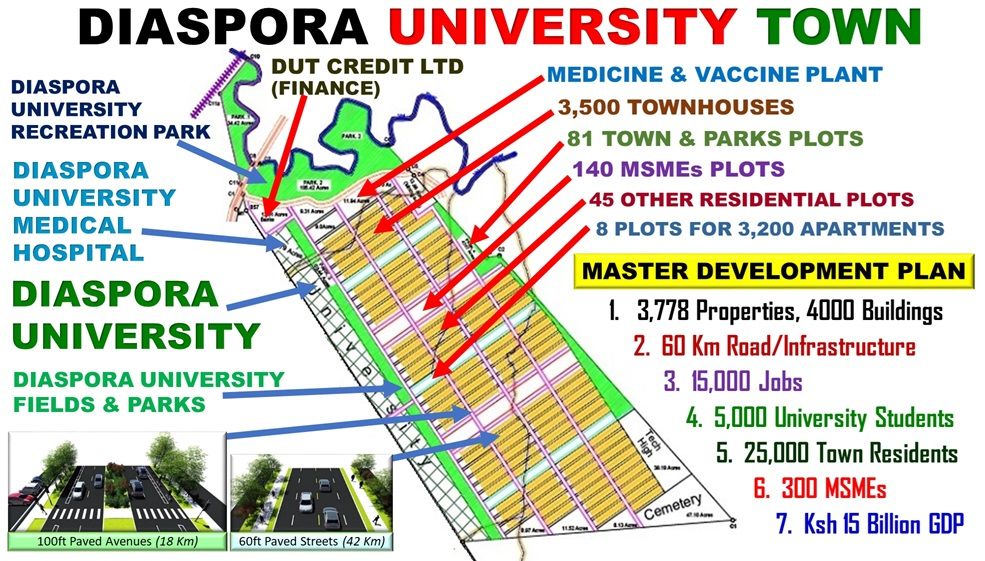

Dan Kamau, the DUT project developer and Master Development Plan creator, during a meeting, presented to the bankers the DUT 20,000 jobs creation and 3,778 properties development plan. He said the DUT plan will grow the assets of the banking sector by Ksh 50 billion as the bank issues residential property mortgages, MSMEs property loans, MSMEs equipment loans, and individual loans.

Prof. Philliph Mutisya, who has lived in the U.S. for over 40 years and is back in Kenya to open the Diaspora University, narrated his mortgage story from when he was in the U.S. He said he lived in the house for over 30 years while paying the mortgage. He pointed out that his house grew in value, and so did his wealth. He said he would refinance his house and withdraw some of his equity to fund the education of his children. He asked how many members of the 30 Ndara B Community members present had a mortgage. The answer was zero.

Dan, talking about the mortgage system, referenced Fannie Mae (The Federal National Mortgage Association), founded in 1938, whose total assets were $4.3 trillion; and Freddie Mac (Federal Home Loan Mortgage Corporation), founded in 1968, whose total assets are reported at $3.2 trillion.

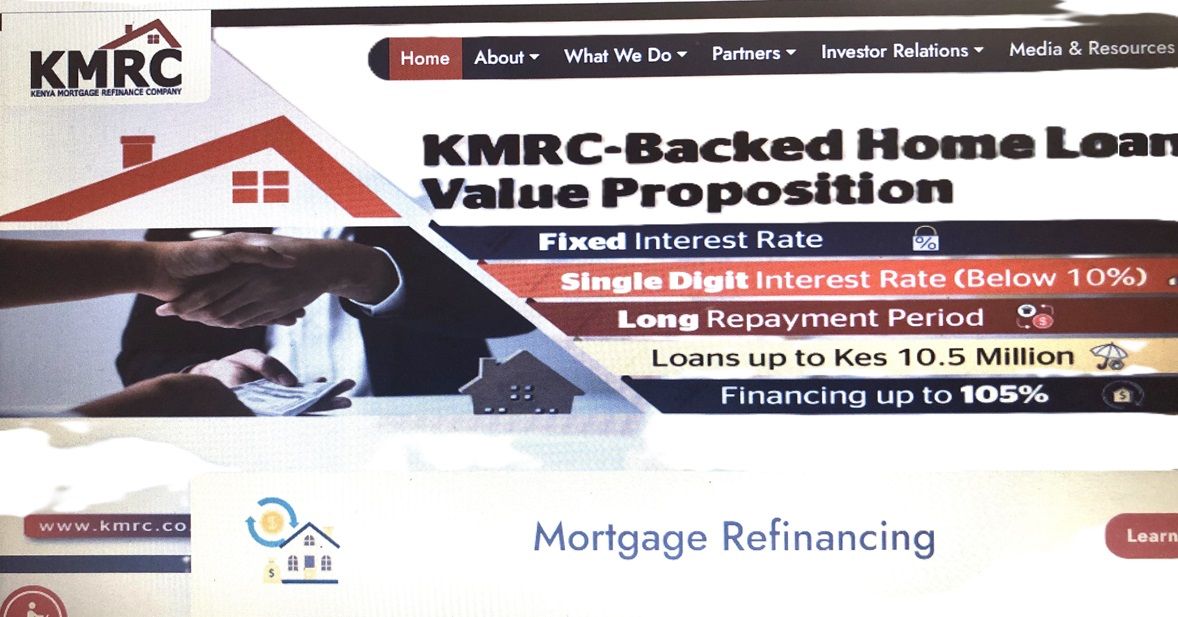

He said the Kenya Mortgage Refinance Company (KMRC) is similar to these two organizations, and through KCB Bank, KMRC can finance the DUT 3,500 townhouses and 3,200 apartments' mortgages of about Ksh 35 billion. He said the mortgage system is not just about a house and the repayment of a mortgage; it is a system of achieving the right of housing, creating wealth and growing Gross Domestic Product (GDP).

Led by Simon Halonda of KCB Diaspora Banking, Nairobi and Benson Mutie, KCB Voi Branch Manager, the team of bankers reviewed the project and said the DUT plan is a good plan. They will look at it and see how the bank can partner.

The partnership proposal submitted was based on financial products and services as follows: Individual Loans to Kenyans; Diaspora Loan to Diaspora Kenyans; 3,500 Townhouse Mortgage loans through KMRC Mortgage Product; DUT Construction loan; MSMEs property loans; and other loans and products.

47 persons were present in the meeting as follows: 11 persons heading DUT plans and DUT MSMEs; the 28 Ndara B Community members working on the Ndara B 30 MSMEs plan; a General Industries Ltd representative who is working on selling water and sewer pipes of about Ksh 500 million; and the 7 KCB bankers.

The 47 persons were all in agreement that it is their responsibility to create jobs so that Kenyans' constitutional rights can be achieved. The Generation Z present on behalf of the other Gen Zs rallied everyone present to do their role. They asked those in the banking sector to understand the role of banking and thereafter to join through financing the diverse products.