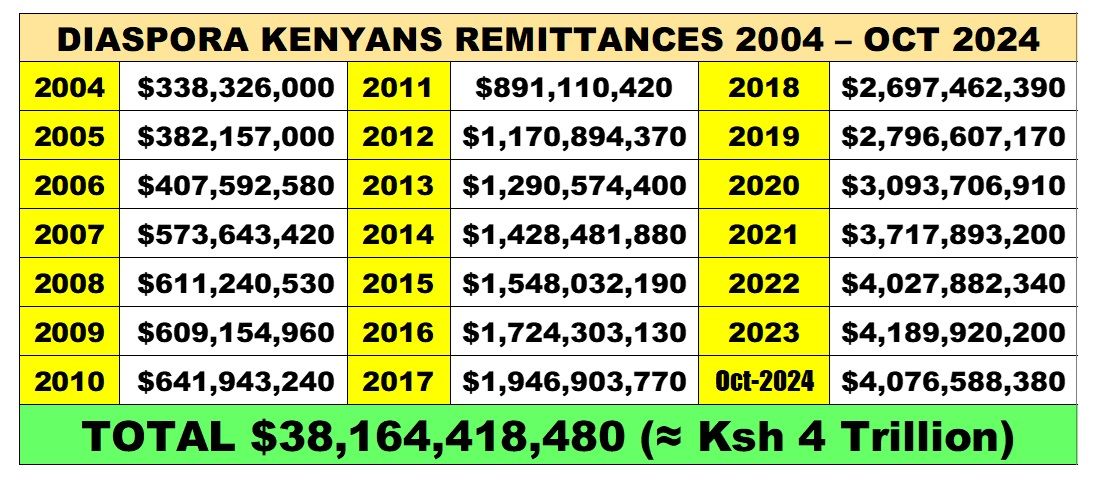

In the mid 2000’s, two approaches of investing Diaspora money to finance Kenya GDP growth were proposed: Infrastructure Bonds and Diaspora Bonds. By 2009 the Infrastructure Bonds were achieved. The Diaspora Bond that was based on tapping Diaspora Remittances was never achieved. Diaspora Kenyans have remitted $38 billion from January 2004 to October 2024.

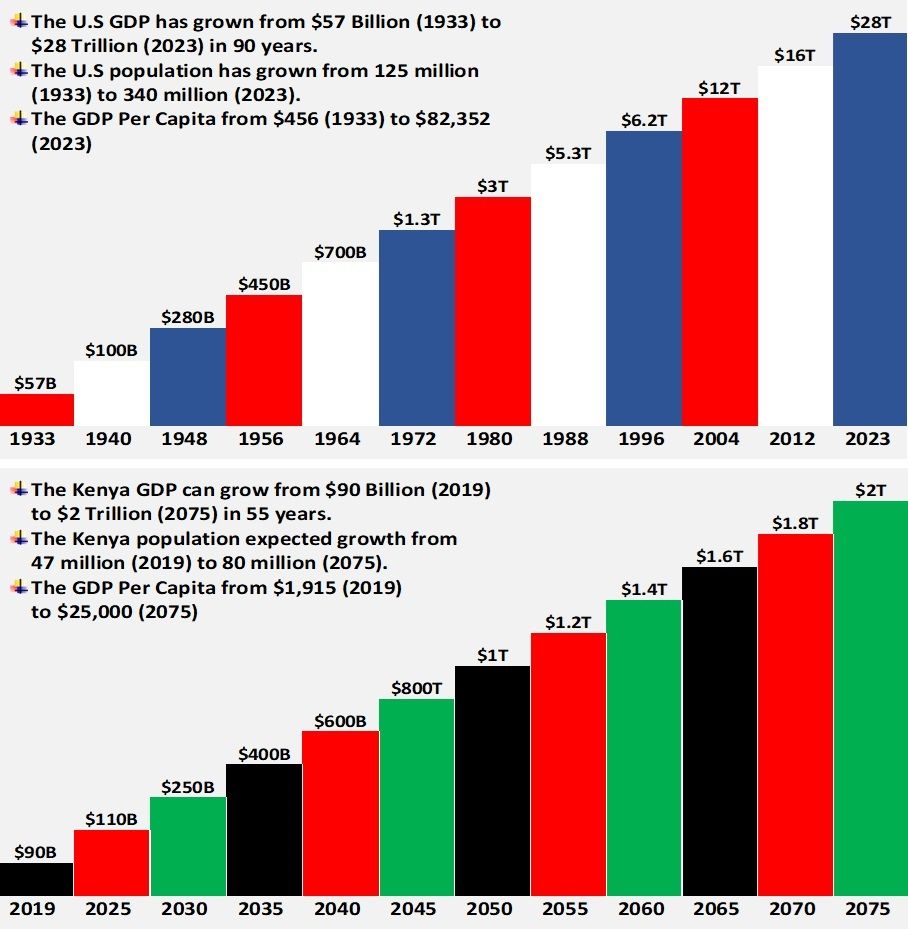

If $10 billion of the remittances had come into Kenya through Diaspora Bonds that finance development plans for jobs creation and GDP growth projects, over 20 million formal jobs would today be created and Kenya GDP would be over $500 billion.

Diaspora Kenyans can in the next 10 years have over $10 billion of their remittance money applied in Diaspora Bonds. The following six plans can be incorporated.

1. Jobs Creation and GDP Growth Plan

For the Diaspora Bond to benefit Kenyans in Kenya and for the Diaspora Kenyans to get a return; the Diaspora Bond issued has to be for a development plan or business plan that creates jobs and grows Kenya Gross Domestic Product (GDP).

The infrastructure bonds, from 2009 to date, failure to incorporate jobs creation and GDP growth plans and systems have led to the finance failing to contribute to the growth of Kenya GDP by double digit and creation of formal employment.

2. Assets Creation Plan

The Diaspora Bond money should at all times be accounted for through cash assets the money and physical property assets. The bond guarantee should be the assets and not Kenyans through the tax system.

3. Diaspora Kenyans Intellectual Resource Plan

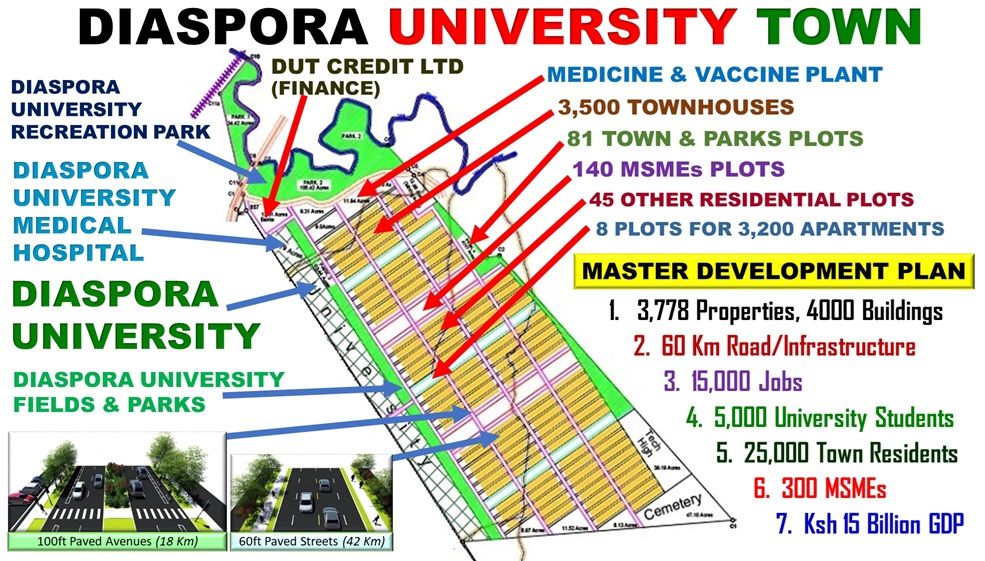

The Diaspora Kenyans intellectual resources should be part of the development plan. There are thousands of Diaspora Kenyans with the expertise to lead in designing, building and operating big projects.

The Diaspora Kenyans should not just invest in bonds; they should also open MSMEs that build and supply the materials. For example if a Diaspora Bond is for $1 billion, the Diaspora Kenyans professionals and MSMEs started by Diaspora Kenyans should be paid for services and products by this money.

4. Diaspora Incentives and Diaspora Bonds Bill Plan

A Diaspora Incentives and Diaspora Bond bill should be established and passed in parliament. The incentives in the bill would enable the Diaspora money to make a return through tax breaks. This would be similar to the Special Economic Zone.

The bill should create an incorporated organization preferably regulated by the Central Bank of Kenya. Those appointed as Board of Directors members should be Diaspora Kenyans appointed by the Diaspora Kenyans investing in the bonds through an electronic system and as per regulation requirements. Diaspora Kenyans should create the bill with as many Diaspora Kenyans participating.

5. ICT System Plan

The ICT system plan to make it possible for Diaspora Kenyans to register and take up the bonds through a website.

6. Projects Bond Financing Plan

Projects that require funding through Diaspora Bond would put up the documents that would include: the development and business plan; the jobs creation plan; the Diaspora Kenyans professionals and organizations who would be implementing the project; and other documents as required. The Diaspora Kenyans registered, would after reading place their bids.

Email: dan@dut.or.ke