Prof. Philliph Mutisya of Raleigh, NC, USA, the Diaspora University lead founder academic system, and Jackson Kimanzi, formerly of Worcester, MA, who is currently the Diaspora University Town (DUT) building materials MSME, met with the KCB Bank team of premium and diaspora banking. The KCB Bank team was led by Simon Halonda, head of KCB Bank premium banking, David Muthoka, the Diaspora Relations Manager, and Joshua Kiptoo of Diaspora Banking Mombasa. The meeting continued the discussions of the Ksh 50 billion DUT finance partnership.

Early this year, the DUT team of Dan Kamau, Diaspora University Trust Executive Trustee, DUT Project Director, and Prof. Mutisya sent a letter to the CEO introducing the Ksh 50 billion opportunity.

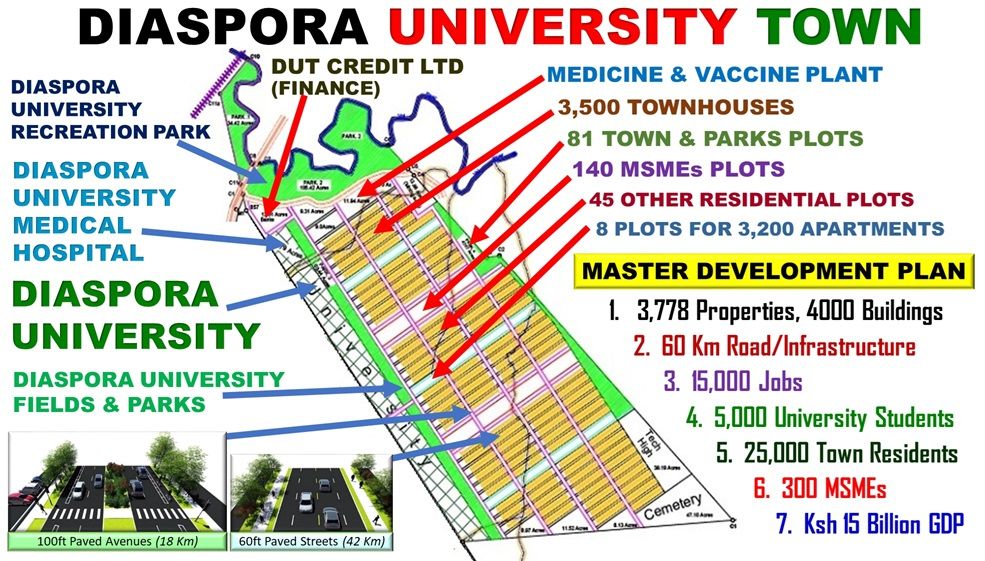

The Ksh 50 billion opportunity was presented as: mortgage loans of Ksh 35 billion to the 6,700 residential properties; property loans to Diaspora University Trust property and assets loans of about Ksh 10 billion; and Microfinance Small and Medium Enterprises (MSMEs), asset and property loans of about Ksh 5 billion.

During the meeting, Simon shared that the Managing Director (MD) of KCB Bank—Kenya, Annastacia Kimtai, liked the DUT project. Dan, the project director, had introduced the project to the MD at a KCB MSMEs event in Voi.

Prof. Mutisya, who is working to enroll his first class at Diaspora University before the end of 2026, was happy to hear the bankers are developing diverse products for financing the properties and other assets that will help achieve the university's goals.

One of the loan products that the Bank is considering is a construction loan to be issued to Diaspora University Trust. This amount will kick off the construction work at DUT and produce the roads and buildings as per the design-build plan established.

Diaspora Kenyans and Kenyans who have become DUT Townhouse developers have started opening and updating their KCB Bank accounts through which they will receive mortgage loans for the completed townhouses. The mortgage loans will support the construction. When all the 3,500 townhouses are completed through construction work of Ksh 22.75 billion and financed by the mortgage loan products, this financing will have funded the construction.

Other loans in consideration are MSMEs and Diaspora University Trust property and assets loans. These finance loans will support job creation by financing the properties, machinery, and vehicles used to produce education, goods, and services.

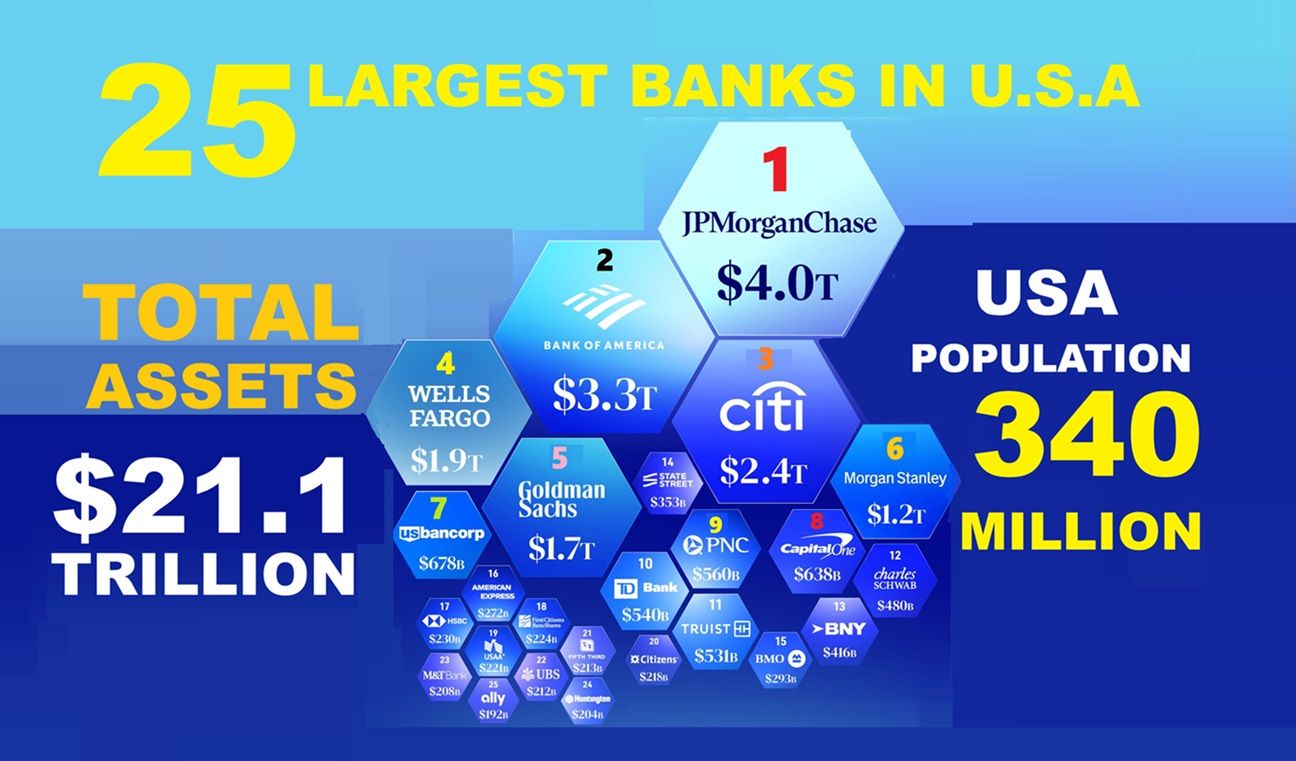

The Ksh 50 billion finance will create 20,000 new jobs and make 100 million hours of human time productive. This productivity will grow banking assets similar to how banking assets grew in the U.S. and achieve housing, education, and other constitutional rights for Kenyans.