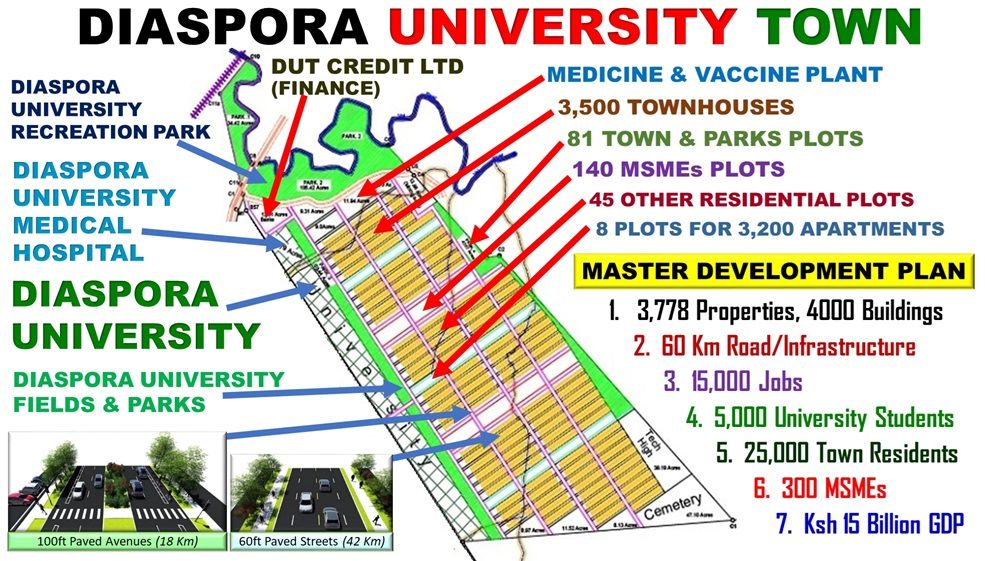

My job at Diaspora University Town (DUT) is as an MSMEs and Property Manager. Every day, I oversee the opening of files for those looking to start a business or organization at DUT and allocate plots for those who would like to construct a building in one of the 140 reserved for MSMEs and organizations. I also manage all the property development files of the 3,778 plots in our master plan.

My job, which has already started, is one of the 20,000 jobs that the DUT Master Development Plan is creating at DUT. Following my getting a job, I've also become a townhouse developer using the DUT Townhouse Investment and Development Agreement (THIDA) system.

Every day I come to work, I’m happy because I’m not just working to get paid; I have also started my journey to becoming a homeowner. To my fellow Gen Z, please join us and let’s build this planned town and other planned towns as we commit to eradicating slums in Kenya and improving the quality of the environment.

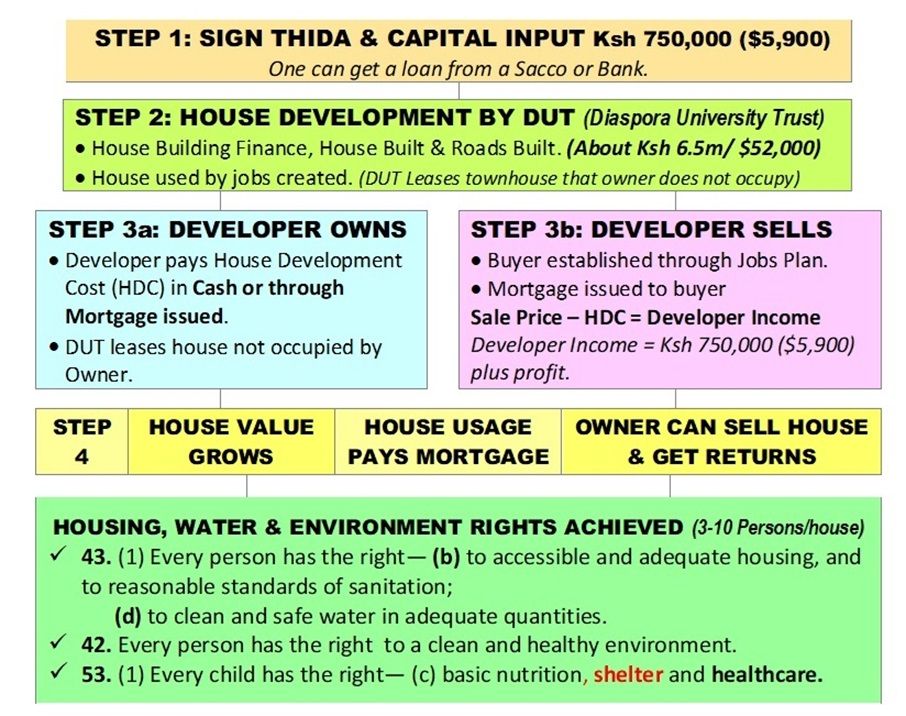

To say, “My Job, My Townhouse at DUT,” a DUT THIDA will need to be signed, and the Capital in the THIDA should be put in. Today, the THIDA system is progressing in the development of 3,500 townhouses. The system includes: 3,500 plots, opening of developer files, allocating the 3,500 plots, townhouse design, townhouse construction plan, completed house mortgages, completed house usage, and the sale of the house.

To my fellow Generation Z: This is your job opportunity. This is your opportunity to start owning a home. Talk to your parents and ask them to sign a DUT THIDA and create your job at DUT.

If your parent takes a loan, agree with him or her that once you get the DUT job, you will take over the payment of the loan instalments, and once the house is complete, you will take the mortgage and clear the loan. You will have a job and a home.

DUT today creates a way for every family with an employed young man or woman to get a job. A parent currently making income through a job or business can take a personal unsecured loan from any financial institution, sign a THIDA, and create a job for their loved one. Note that it is not having the cash that leads to job creation. It is the willingness of those who can to get finance and direct it to job creation.

To my fellow Gen Z, if your parents took a loan, start paying the monthly instalments so you can own the property. For example, if your job opens in month 5, you should take over the instalment payments.

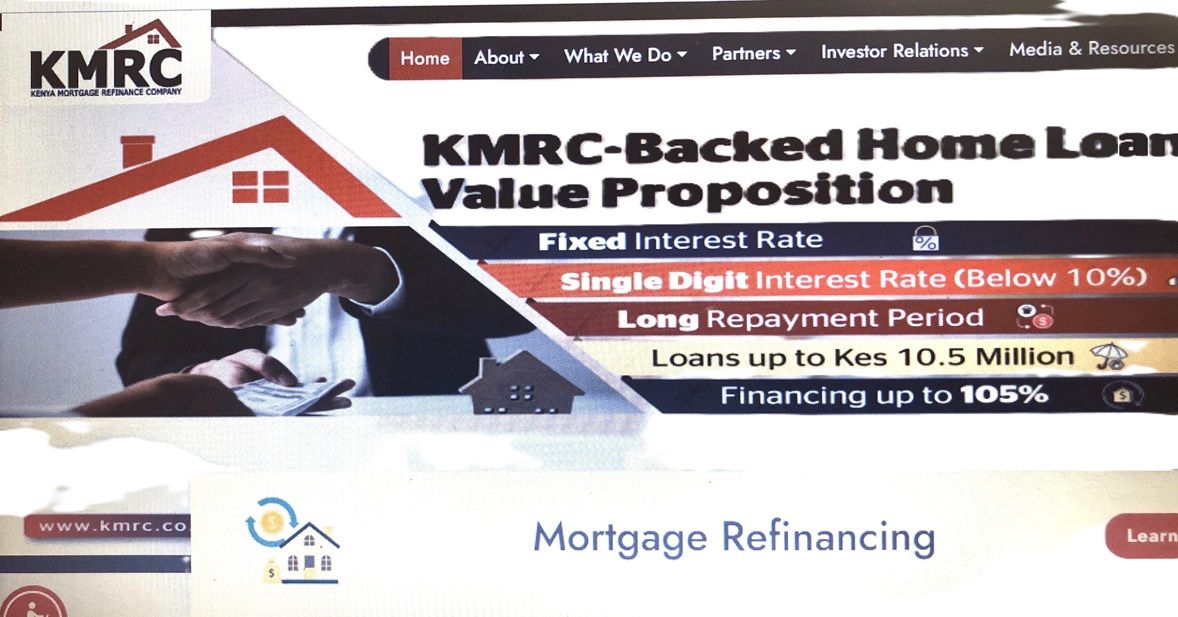

When the house is completed, for example, in month 30, take the KMRC mortgage through one of the 20 Mortgage Primary lenders and pay off the house development cost and your parents' loan principal balance.

Based on this approach, if your parent had taken a 120-month loan and paid five installments, you would then pay installments 6 to 30 and clear their loan principal balance in month 30. More importantly, you would be working and building your wealth

Using the DUT Jobs Creation and Houses development system, a Gen Z who has finished college or is about to finish college could get a job and be a homeowner in as few as 30 months if their parent is willing to create the job for them.

The house will be financed through the KMRC mortgage finance product that 20 financial institutions are offering. An example of the product offered is the KCB Mortgage, which is 105% finance, up to Ksh 10.5 million, 9%, and a 25-year tenor.

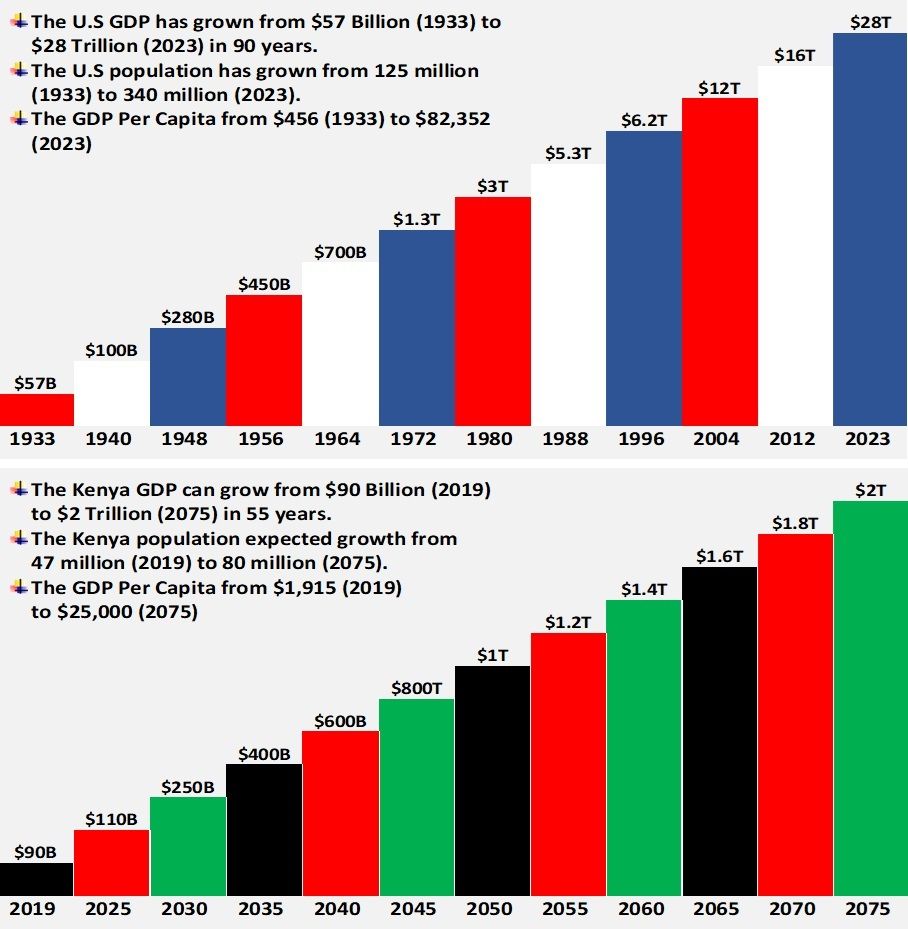

The DUT GDP growth system will enable every person who gets a job to pay their mortgage as they work.

(Faith Mwachala, the writer, is the DUT MSME & Property Manager. Reach out to Faith through sme@dut.or.ke)