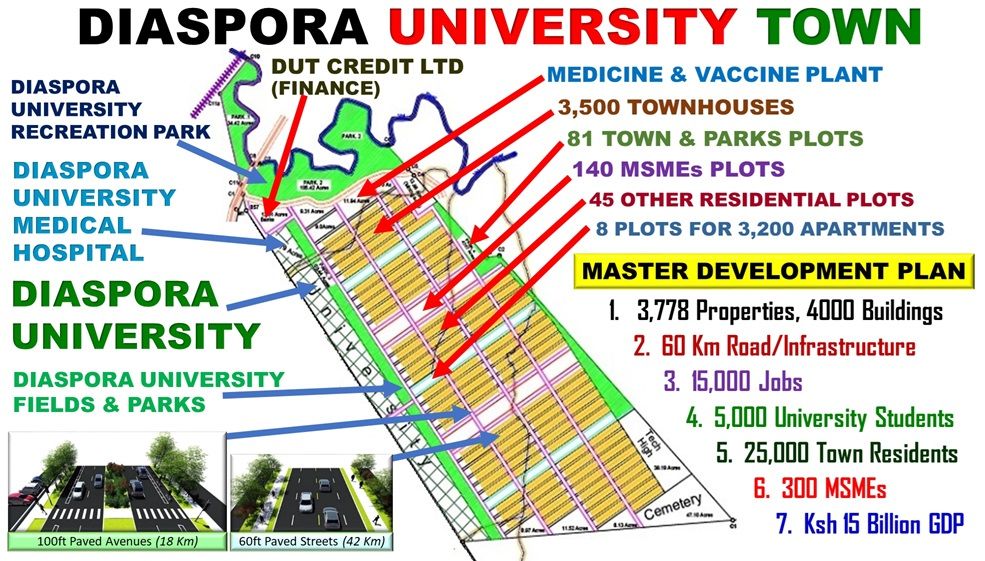

Diaspora University Town (DUT) is progressing to achieve the money for DUT 20,000 jobs creation and 3,778 properties plan. Dan Kamau, the Diaspora University Trust Executive Trustee and Diaspora University Town Project Director, and Ronald Mwangombe, a Trustee and founder of DUT Materials MSME, engaged bankers in Upper hill, Nairobi. The DUT 2025 – 2029 plan is looking for a bank that wants to issue some of the Ksh 70 billion DUT loans as 20,000 jobs are created for Generation Z and 3,778 properties developed.

Following the meeting with bankers, the DUT trustees updated the founders across the World during a Saturday Zoom meeting. Dan said that he was optimistic that the bank professionals will put the needed time to understand the finance products required by DUT and have their bank issue the products. The Ksh 70 billion will be injected into the project through about 10,000 loans to individuals, MSMEs, and to Diaspora University.

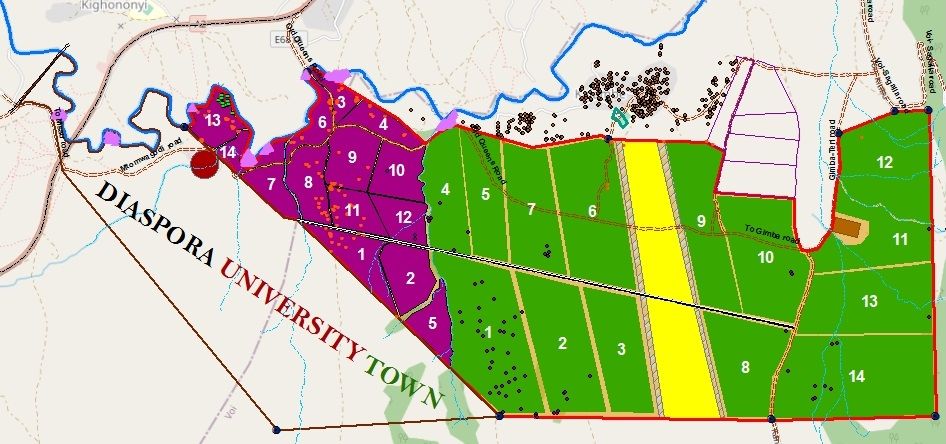

Ronald said that the other resources of land and human resources are ready. He said that he informed the bankers that Ndara B Community is a community of about 10,000 persons whose land has natural resources for producing building materials. He said through the 28 MSMEs the community is starting, 15 MSMEs will be for producing building materials.

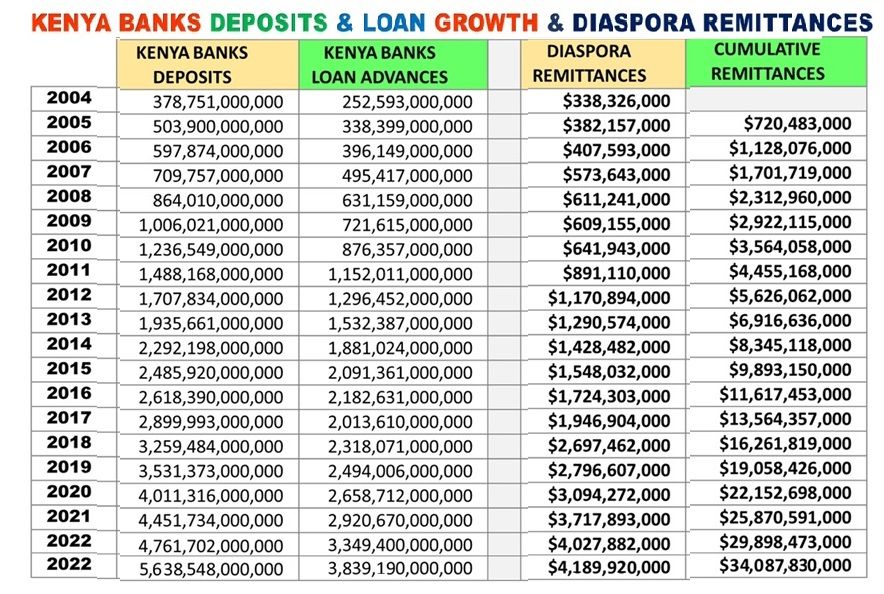

As natural resources and 20,000 persons work in the 5 year plan new deposits will be created that could grow to Ksh 70 billion. This means the Ksh 70 billion loans could come from these deposits. The Diaspora Kenyans remittances have shown how jobs created abroad have played a role in expanding the bank deposits and loans in Kenya.

Dan who keeps track of the Kenya banking sector through the yearly Central Bank of Kenya (CBK) report informed Diaspora Kenyans and Kenyans in the zoom meeting that the banking sector grew in 2023. He said the reports show the deposits in Banks and Microfinance at the end of 2023 at Ksh 5.9 trillion (About total deposits have grown to about Ksh 5.9 Trillion (About $50 billion). The loans advanced from these deposits to individuals and MSMEs were reported at Ksh 3.8 trillion ($30 billion).

Dan said one of the reasons why there is low job creation is because banks do not lend toward jobs creation. In turn bank deposits don’t grow as fast for the main driver of deposits growth is people working and turning their time to cash. He said Canada has 2 banks with deposits at about $1 trillion even when their 40 million population is lower than the Kenya 52 million population.

The DUT plan as the first class enrolled at Diaspora University graduates after 4 years will create Ksh 150 billion of new wealth or assets held in property and MSMEs. The 150 million assets will be financed by capital and loans of about Ksh 70 Billion. The Ksh 70 billion loans are an opportunity. More importantly, over 100 million hours of human resources will have been applied productively.

Personal Loans for Investment in DUT. Ksh 1.65 Billion

DUT has an opportunity for persons to become DUT Townhouse Developers. The project has 2,200 products of Ksh 750,000 ($5,900). A bank can issue loans to even 2,200 persons and grow its loan book.

DUT Construction Loan. Ksh 1 Billion

The DUT Design-Build construction loan opportunity is a Ksh 1 billion credit line. The amount would be progressively applied to delivery buildings and roads.

3,500 Townhouses Mortgages Ksh 25 Billion

The mortgages would be issued to about 3,500 individuals by Primary Mortgage Lender affiliated with KMRC as townhouses are completed and occupied. KMRC finance product of up to Ksh 10.5 million, interest Ksh 9 million and 25 years tenor. This aligns with the DUT sustainable system that has the usage of townhouse at Ksh 65,000 per month.

3,200 Apartments Mortgages of About Ksh 10 Billion

The mortgages would be issued to about 3,500 individuals by Primary Mortgage Lender affiliated with KMRC as townhouses are completed and occupied. KMRC finance product of up to Ksh 10.5 million, interest Ksh 9 million and 25 years tenor. This aligns with the DUT sustainable system.

Diaspora University and Town Properties, Equipment and Vehicle Loans Ksh 10 billion

The Diaspora University property loans to the 5 university properties and 81 town properties would be issued by financial institutions to the Diaspora University Trust. About Ksh 10 billion loans would be issued.

MSMEs and Organizations property and business loans, Ksh 25 billion

The DUT 300 MSMEs, 140 MSMEs and Organizations properties, 30 Ndara B MSMEs setting up in the 4,000 acres will get loans for buildings, equipment and vehicles. The estimate is that over 25 billion loans will be issued to support the attainment of constitutional rights of Kenyans.

Dan Kamau be reached through dan@dut.or.ke