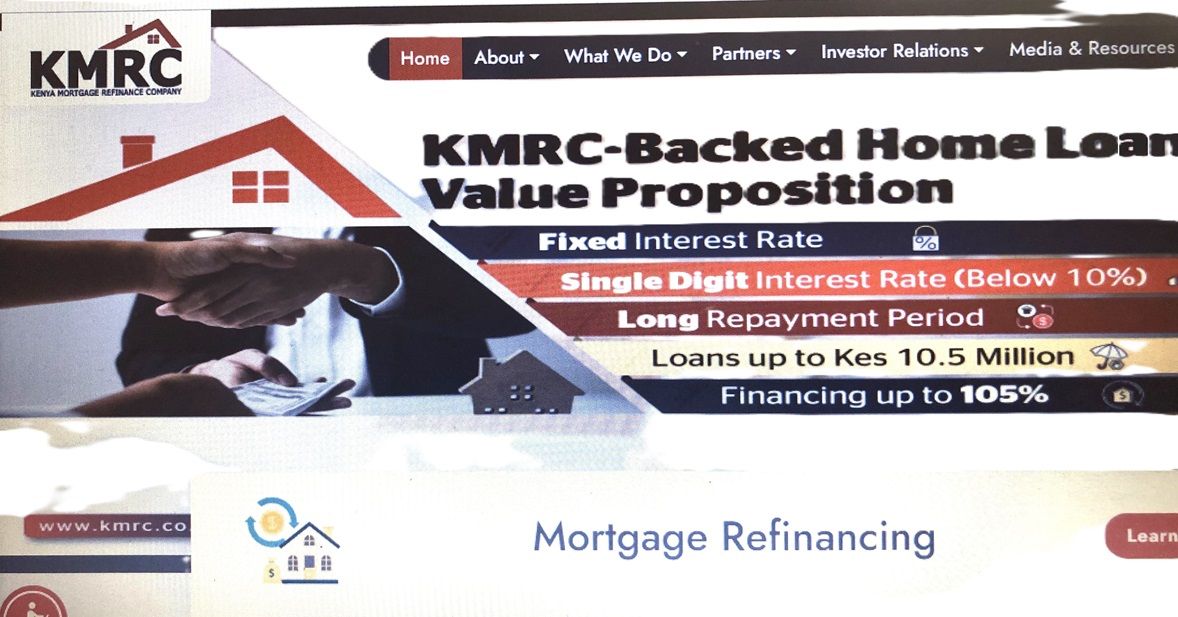

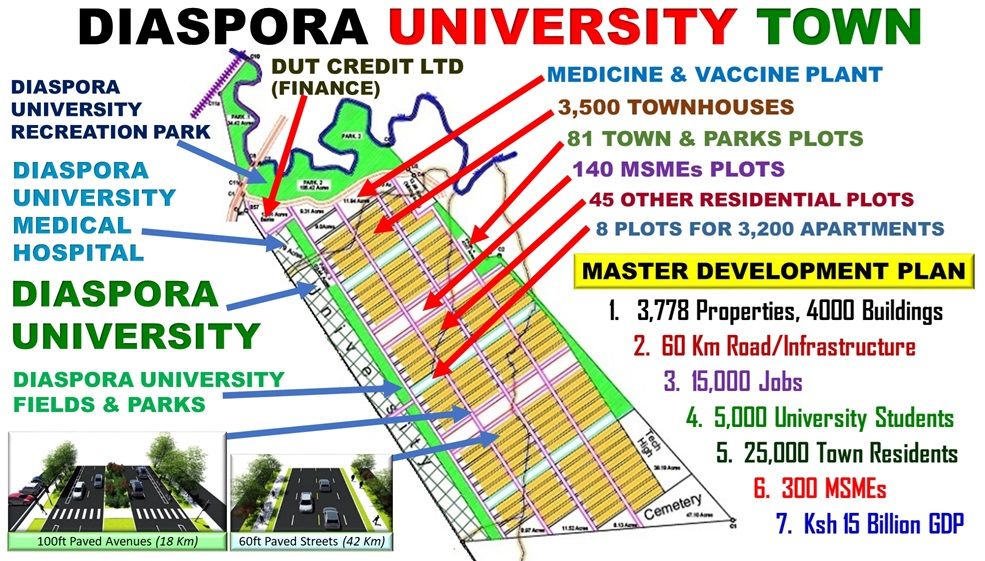

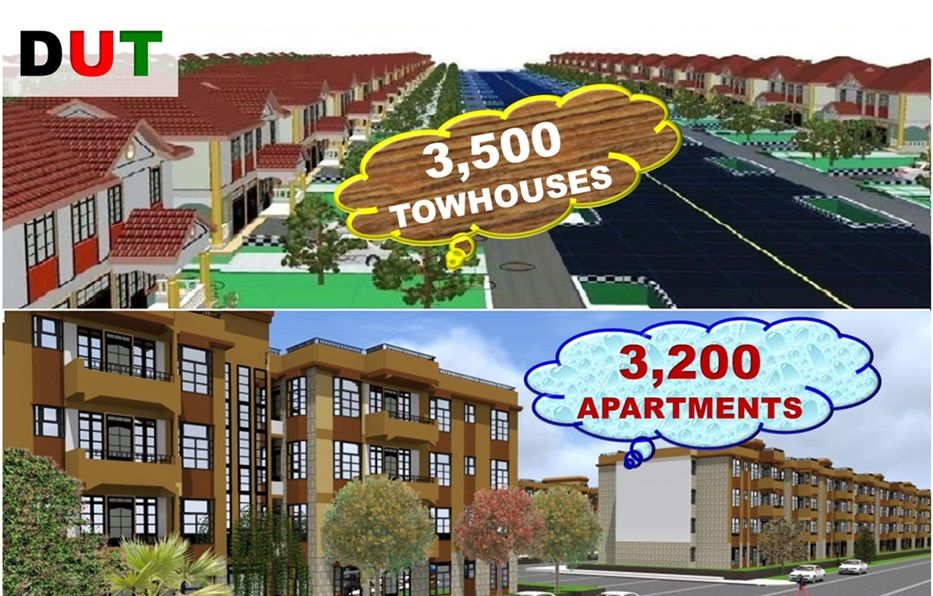

The annual report of Kenya Mortgage Refinance Company (KMRC) gives a mortgage product as follows: Single digit interest, fixed interest rate, repayment period of 25 years and financing of up to 105%. Diaspora University Town is on track to create 20,000 jobs and develop 6,700 units of housing (3,500 Townhouses and 3,200 apartments). The KMRC finance product can be part of creating 20,000 jobs and developing 6,700 affordable houses at DUT.

The report records the KMRC owners as follows: Kenya Government (Kenyans) though the Treasury owns 25%; 8 Commercial Banks (KCB Bank Kenya, Cooperative Bank, DTB, HFC Limited, NCBA Bank, Absa Bank Kenya, Stanbic Bank and Credit Bank) own 44%; 11 SACCOS (Kenya Police, Mwalimu National, Safaricom, Apstar (Formerly Ukulima), Bingwa, Imarisha, Unaitas, Imarika, Tower, Stima and Harambee) own 7.9%; One microfinance bank, Kenya Women Microfinance Bank (KWFT) owns 0.6%; One Multilateral Development Partner, International Finance Corporation (IFC) of the World Bank group owns 11.8% and, a Pan African Housing Finance Institution, Shelter Afrique Development Bank owns 11.1%.

The shares and share capital to be issued is 50 million shares of Ksh 100 a total capital of Ksh 5 billion. The 2023 report shows the share capital issued at the end of 2023 was Ksh 1,808,375,125. This means another Ksh 3.2 billion can be raised from shares issue.

The KMRC 2023 report further shows that the company has two credit lines totaling €291.4 million Euros from World Bank & Africa Development Bank that were established in 2020. From 2020 to 2023 the amount drawn is €148 million Euro’s. This is recorded in the KMRC Balance Sheet as Ksh 20,662,582,125 that includes accrued interest.

The report indicates that €142 million Euros, about Ksh 19.7 billion based on the current exchange rate of €1 Euro to Ksh 139, was available at the end of 2023.

As DUT progresses to create jobs and develop houses, persons getting the jobs will tap this money as they live and own these houses. The fact that the company is owned by financial institutions and has credit lines from the World Bank and Africa Development Bank means the company can avail the money as the houses are developed and completed.

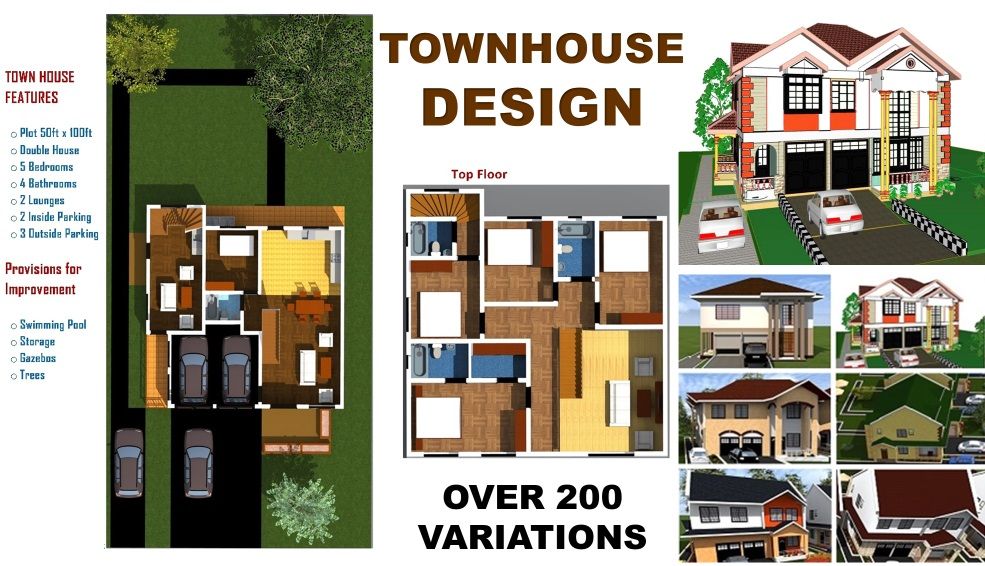

The DUT plan will produce 3,500 townhouses whose mortgage finance is not expected to exceed Ksh 9 million per unit. The total mortgage business established through the 3,500 townhouses will be about Ksh 25 billion.

Another 3,200 apartments will be produced with the mortgage finance ranging from Ksh2 million to Ksh 5 million. The total mortgage business established through the 3,500 townhouses will be about Ksh 10 billion.

Persons taking up the 15,000 DUT jobs created will be able to qualify to take up the townhouses and apartments. They will service the mortgage from the new GDP developed at Diaspora University Town of about Ksh 20 billion.

The KMRC lists 20 primary mortgage lenders as follows: KCB Bank Kenya, Cooperative Bank, DTB, HFC Limited, NCBA Bank, Absa Bank Kenya, Stanbic Bank, Credit Bank, Kenya Police Sacco, Mwalimu National Sacco, Safaricom Sacco, Apstar Sacco, Bingwa Sacco, Imarisha Sacco, Unaitas Sacco, Imarika Sacco, Tower Sacco, Stima Sacco, Harambee Sacco and Kenya Women Microfinance Bank (KWFT).

DUT is looking to establish MOUs with some of the Primary Mortgage Lenders who shall issue the mortgages as the jobs and houses are completed.

About 30,000 Kenyans will get their Kenya constitution rights in articles 42, 43 and 53 of environment, housing and clean water from the 6,700 units produced and the KMRC mortgage finance.