Roy Muli Musyoka has started the Kanunga High Alumni Diaspora University Founder Plan. The plan aims to engage Kanunga High alumni in the founding of Diaspora University and Diaspora University Town. Roy says, “Kanunga Alumni should be in the list of Diaspora University founders and be part of the project through the DUT plan of job creation and invest in MSMEs.”

Roy says the opportunities in the DUT project are numerous, and he is impressed that Dan Mbuthi Kamau, an alumnus of Kanunga High, is spearheading the project, which has many other founders. Dan is the Diaspora University Trust Executive Trustee and the project director for the Diaspora University Town project.

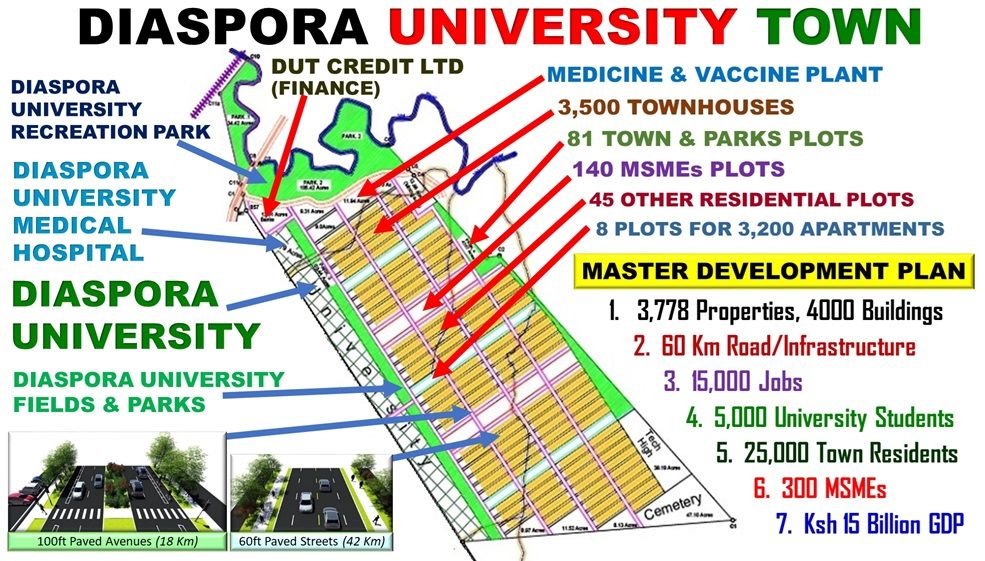

The project is progressing to develop a university that will grow to 5,000 students, a town that will grow to 25,000 residents, and create 15,000 jobs, achieving a town GDP of Ksh 20 billion and new wealth of about Ksh 200 billion through 3,778 properties developed and 300 MSMEs opened in town.

Kanunga alumni will not only be Diaspora University's founders but also creators of this new wealth. As a career banker, Roy is also looking to advance his banking career through the DUT plan.

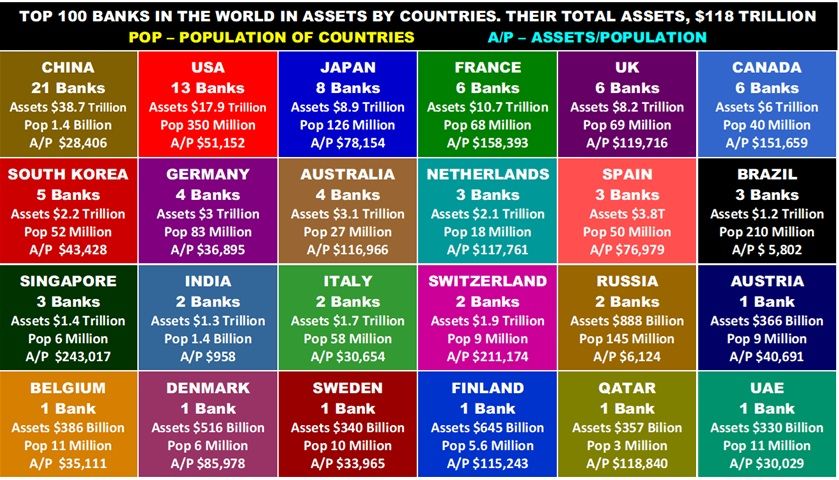

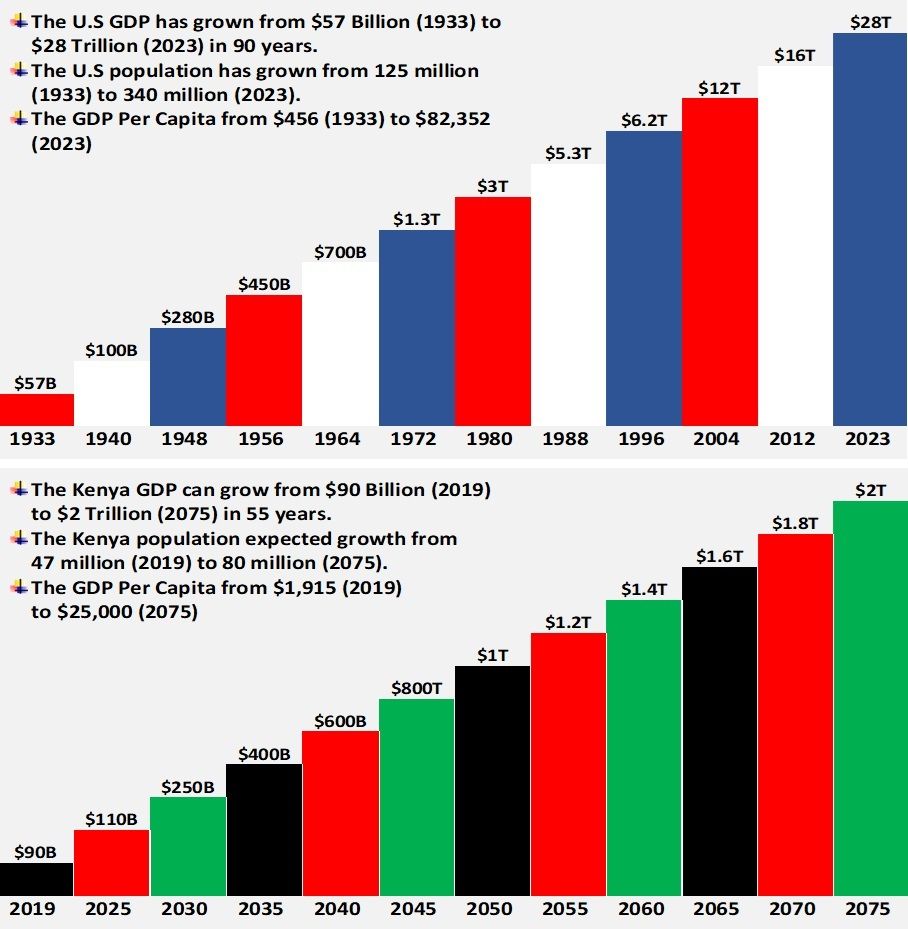

Global financial reports indicate that the top 100 banks worldwide hold $118 trillion in assets. 21 banks are in China and hold $39 trillion in assets. 13 banks are in the US and hold $18 trillion in assets. 8 banks are in Japan and hold $10 trillion. 6 banks in France hold another $10 trillion. 6 UK banks hold $8 trillion in assets. 6 banks in Canada hold $6 trillion in assets. This shows the opportunity to grow banking through bank assets and GDP growth.

Kenya's total banking sector assets, according to the 2024 Central Bank of Kenya (CBK) report, were Ksh 7 trillion (about $60 billion). Singapore has three banks among the world's top 100. The combined banking assets of the three banks total $1.4 trillion. The three banks' assets are 25 times the total Kenya banking assets.

Roy sees this as an opportunity for Kanunga Alumni and Kenyans to grow the banking sector. He is exploring how to establish a capital fund that Kanunga Alumni and Kenyans can contribute to. The funds achieved would be invested in the financial institution DUT Credit Ltd, which is part of the DUT project.

The 30,000 credit products opportunity in the DUT of property loans. MSME loans and other loans will grow banking assets. The DUT approach to job creation and property development, when driving GDP growth, has the potential to build a financial institution that, alongside other financial institutions, increases Kenya's banking assets from the current $60 billion to over $1 trillion, similar to what other countries have achieved.