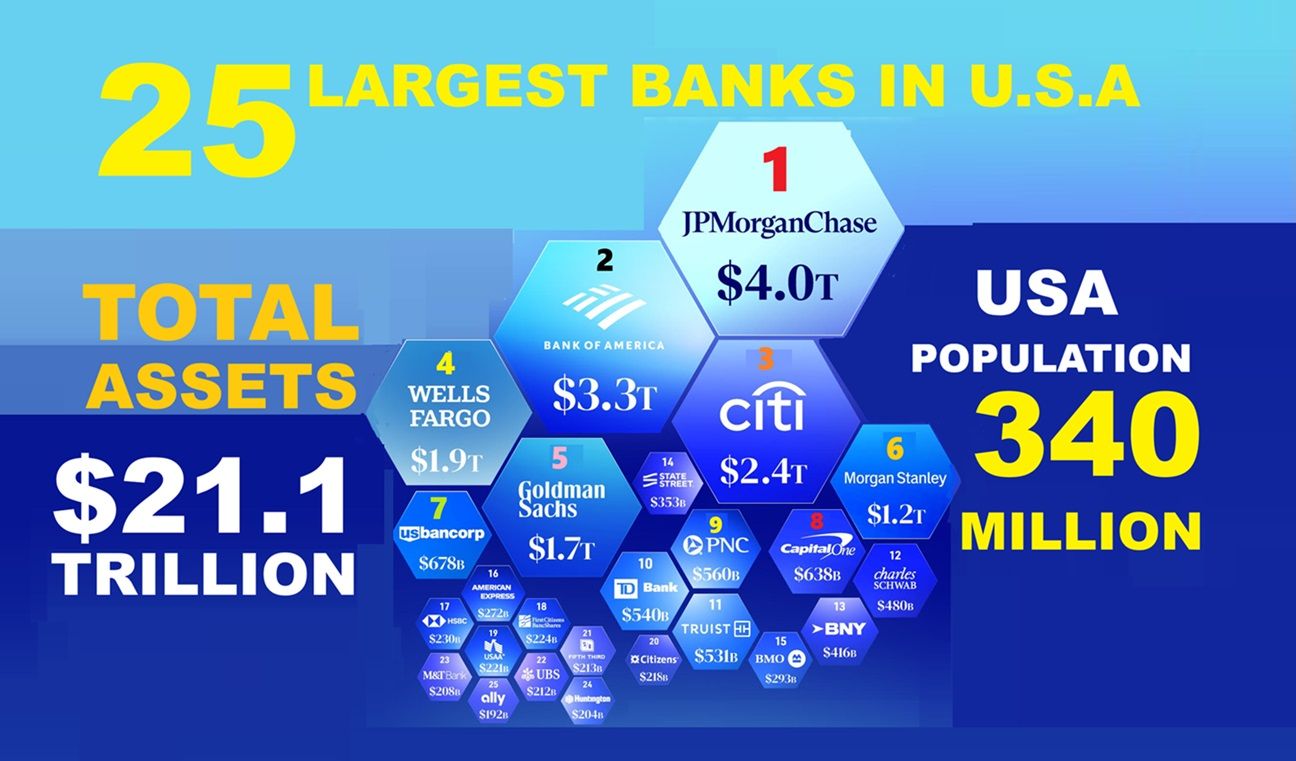

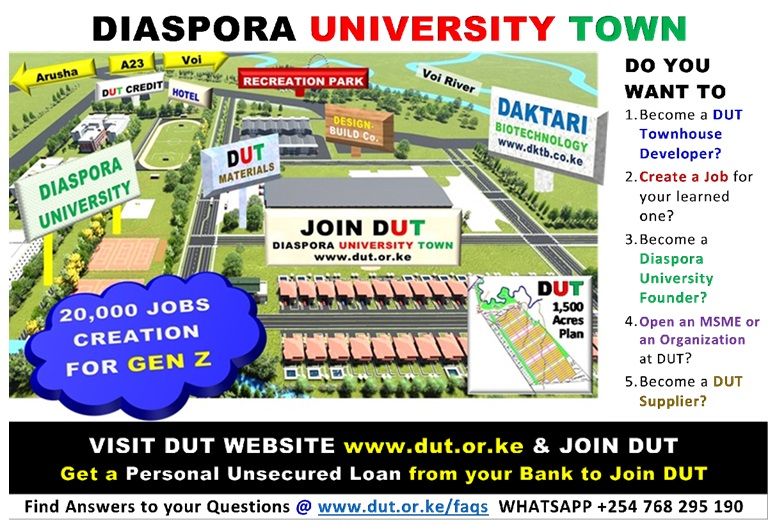

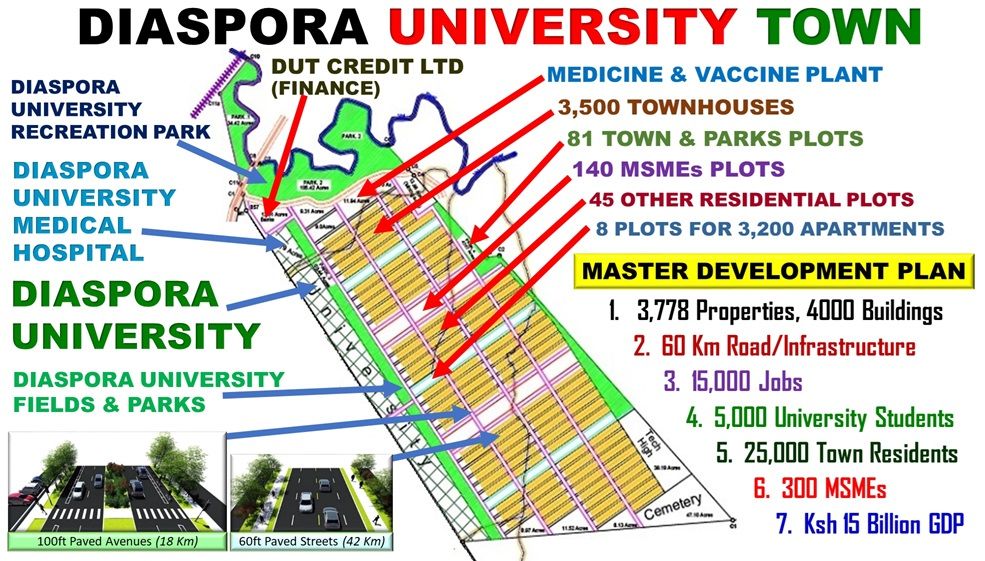

The most significant contributor to the Bank's asset growth is loans. Loans create jobs, and jobs , in turn, generate more loans. The $21.1 trillion in banking assets of the top 25 banks in the U.S. has been achieved through job growth. Diaspora University Town (DUT) is at the stage of growing banking assets in Kenya through its job creation, housing development, and GDP growth system. Dan Kamau, the DUT Executive Trustee and Project Director, says, “DUT will in the next 5 years grow banking assets by Ksh 70 billion as the DUT 20,000 jobs creation plan, the 3,500 townhouses development plan, and the Ksh 20 billion GDP growth plan are achieved.”

Dan, who started the DUT development plan when living in the U.S., says, “The plan today is advanced by 500 Diaspora Kenyans, Ndara B Community, and Kenyans. We aim to bring in another 1,500 Kenyans in the next month.” He adds, “The 1,500 Kenyans will join DUT by becoming townhouse developers using the DUT THIDA system and borrowing personal loans.”

Create jobs for loved ones.

There are approximately 9 million Kenyans in the 18 – 30 years bracket. Most do not have jobs. The 1,500 people joining DUT as townhouse developers will do so to create jobs for others. Dan says, “Today, the DUT plan is headed to create 20,000 jobs. 500 Diaspora Kenyans are already on board. Ndara B Community is on board. From the 5 million Kenyans with formal jobs who can earn, shall get 1,500.” The goal is to get as many from Taita Taveta County as possible.

Become a Diaspora University Founder

Diaspora University plans to achieve a university with a level 5/6 hospital. The 1,500 will be recorded as founders of the University and hospital. Dan says, “We want Kenyans who understand the role a university and a hospital play. We will build a hospital in Kenya so that no one has to leave the country for treatment.

Open an MSME or an Organization at DUT?

300 Micro, Small, and Medium Enterprises and Organizations will be open at Diaspora University Town (DUT). After joining, those who would like to expand their businesses or start new ones will be able to do so.

Become a DUT Supplier?

The design-build budget of Ksh 39.5 billion, which has already commenced, presents an excellent opportunity for those who wish to increase their revenues by supplying this plan. The new GDP of Ksh 20 billion will also create new opportunities. Diaspora University will create opportunities for suppliers through this new GDP.

New Wealth

Every townhouse will create new wealth. The current estimate is that the townhouse value will grow as the University, Hospital, Design-build Company, medicine Vaccine Company, and other MSMEs are established in the town. This growth will achieve a return for the townhouse developers.

BANK PRODUCTS TO BE APPLIED

PERSONAL LOAN

Individuals can join DUT through any of the following loans:

Absa: https://www.absabank.co.ke/personal/get-a-home-loan/

Cooperative Bank: https://www.goodhome.co.ke

DTB: https://dtbk.dtbafrica.com/loans/morgage_facilities

Credit Bank: https://creditbank.co.ke/personal-banking/borrow

KCB: https://ke.kcbgroup.com/for-youfor-you/get-a-loan/unsecured-loan/personal

KWFT: https://www.kwftbank.com/micro-housing-nyumba-smart/

NCBA: https://ke.ncbagroup.com/loan/own-your-own-home/

Stanbic Bank: https://www.stanbicbank.co.ke/kenya/personal/products-and-services/borrow-for-your-needs/see-all-home-loans/home-loan

Echo Bank: https://ecobank.com/personal-banking/products-services/loans

I&M Bank: https://www.imbankgroup.com/ke/im-bank-miliki-nyumba/

Kingdom Bank: https://www.kingdombankltd.co.ke/borrow/unsecured-business-loan/

Sidian Bank: https://sidianbank.co.ke/trade-finance/

Bingwa Sacco: https://www.bingwasacco.coop/long-term-loans/development-loans

Harambee Sacco: https://harambeesacco.com/?page_id=28

HF Group: https://www.hfgroup.co.ke/borrow/for-individuals/property-financing/affordable-housing

Imarika Sacco: https://www.imarika.or.ke/products-services/morgage-loan/

Imarisha Sacco: https://www.imarishasacco.co.ke/

Police Sacco: https://policesacco.com/home-loan-application-requirements/

Mwalimu Sacco: https://www.mwalimunational.coop/

Qona Sacco:https://qonasacco.com/pylon_service/kmrc-mortgage-faraji-ready-homes-construction-loan/

Stima Sacco:https://www.stima-sacco.com/mortgage-facilities/

Tower Sacco: https://towersacco.co.ke/loan/home-loan/

Appstar Sacco:https://apstarsacco.coop/makao-home-plan/

Unitas Sacco:https://www.unaitas.com/real-estate/

Wanandege Sacco: https://www.wanandegesacco.com/

National Sacco: https://nationsacco.com/loan/mortgage-loans/

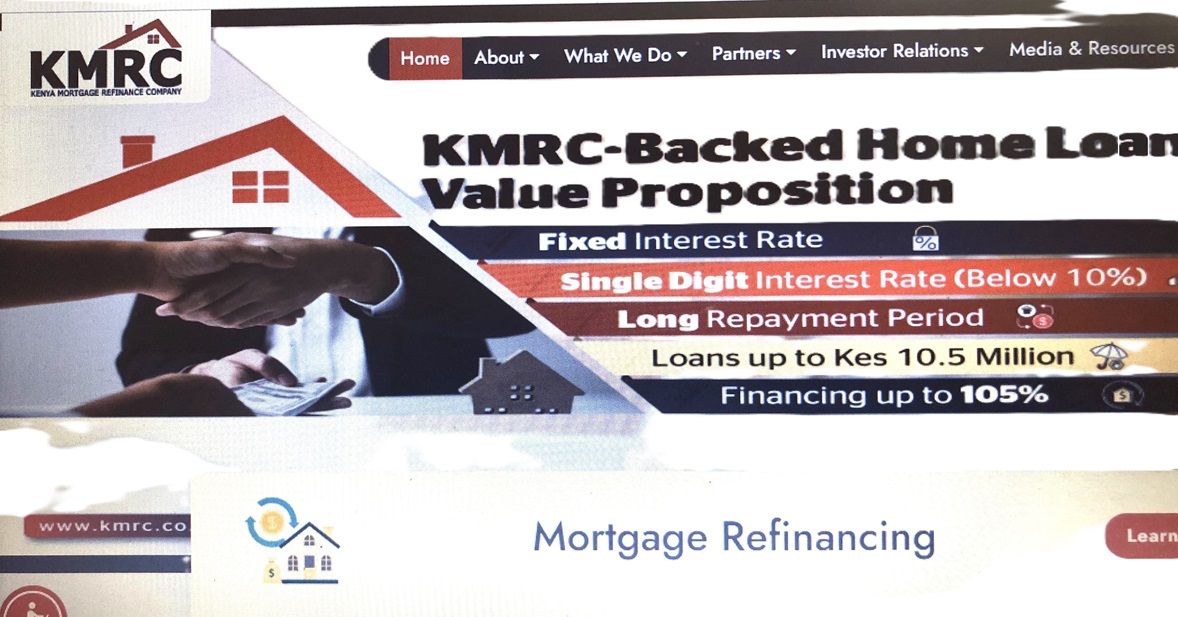

MORTGAGE

Once the townhouses are completed, the following mortgage loans from KMRC, advanced through financial institutions, will increase banking assets by over Ksh 25 billion.