Dan Kamau the Diaspora University Town (DUT) project director and Diaspora University Trust executive trustee answered questions on the Ksh 44.5 billion mortgages of townhouses, apartments and other buildings.

What is a mortgage?

A mortgage is a loan given by a financial institution for the purchase of a building property, land property and other real estate. The person or entity given the mortgage loan pays back the loan over a period of time that can extend to even 30 years. The repayment is done through a principal and the interest. The principal goes to repay back the money and the interest is the income of the lender. The property serves as a collateral of the loan.

In most towns and cities the mortgage is aligned with the jobs in that town and city. The jobs provide new deposits to the financial institutions and the financial institution apply the deposits toward the achievement of the right of housing.

Tell us about the DUT Ksh 44.5 billion mortgages?

As DUT 15,000 jobs creation plan, Ndara B 5,000 jobs creation and DUT Diaspora Kenyans investment plan are implemented they shall progressively grow the Kenya Banks deposits by over Ksh 50 billion. The Ksh 44.5 billion mortgages will be issued from theses new deposits to about 6,800 properties, developed as: townhouses, apartments, university buildings, MSMEs buildings and other organizations building.

The Ksh 44.5 billion mortgages will give about 30,000 Kenyans their right of housing every day. The mortgages will be repaid as persons work.

Is a mortgage a requirement in achieving the right of housing?

Yes. Kenyans awarded themselves the right of housing in Kenya Constitution article 43 that reads, “(1) Every person has the right— (b) to accessible and adequate housing, and to reasonable standards of sanitation.”

The mortgage system is part of achieving the housing right. Countries where the right of housing is achieved and there are no slums have used the mortgage system to achieve the right and also grow the banking sector assets.

How does the banking system facilitate mortgages?

A google search of the U.S banking reveals that as of March 31, 2023, there were 4,096 commercial banks and 576 savings and loan associations in the U.S. insured by the Federal Deposit Insurance Corporation (FDIC) with US$23.7 trillion in assets. The $23.7 trillion divided by the 350 million population in the U.S gives a figure of $67,700 per person. The biggest percentage of the $67,700 assets per individual is directed to residential home mortgages.

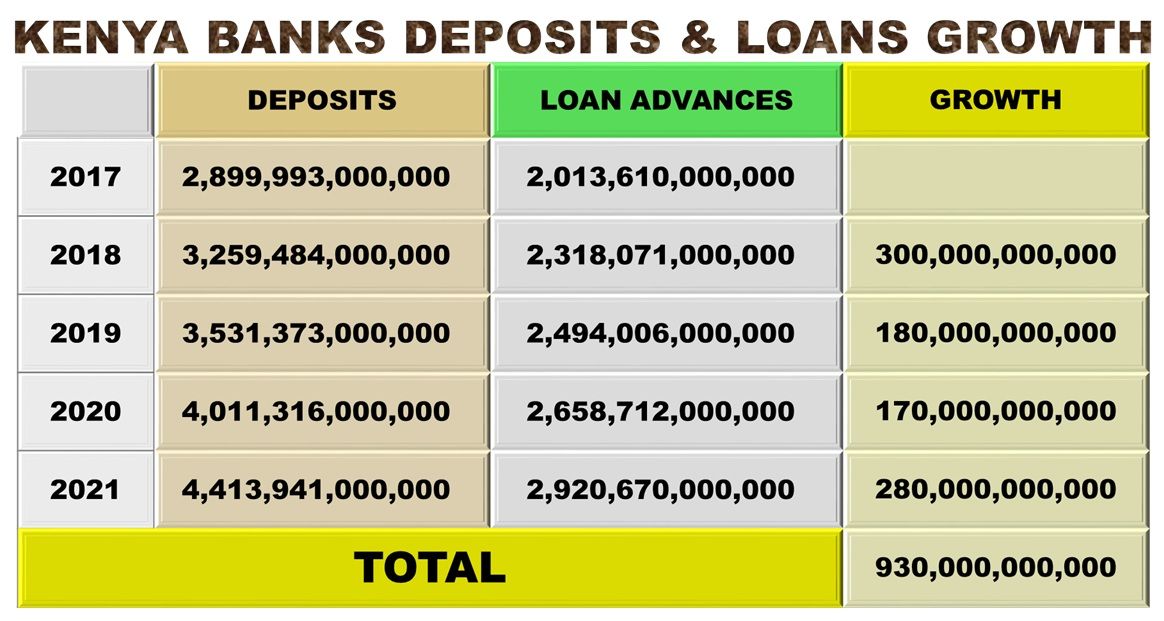

The Central Bank of Kenya banking supervisory report of 2022 showed that at the close of 2022 there were 39 banks with total assets of Ksh 6.02 trillion and 14 microfinance banks with total assets of Ksh 70 billion. This totals to 53 banks with total assets of Ksh 6.1 trillion. Factored based on an exchange rate of Ksh 100 to the dollar. The assets valuation in dollars would be $61 billion. The $61 billion divided by the 52 million Kenyans gives a figure of $1,173.

The biggest assets of banking are loan advances. The above comparative analysis shows that the Kenya banking sector needs to grow loans. The biggest growth of loans is achieved through mortgage loans.

Kenya has a deficit of 3 million houses and a yearly demand of 300,000. This totals to 6 million houses that can be issued 6 million mortgages once built. Based on DUT calculations this would create about Ksh 30 trillion house assets and mortgage assets. Kenya banking would grow by Ksh 30 trillion. There is a need to innovate banking products that enable more houses built so Kenyans can achieve their constitutional rights.

How do you innovate a mortgage product to grow housing and achieve constitution rights?

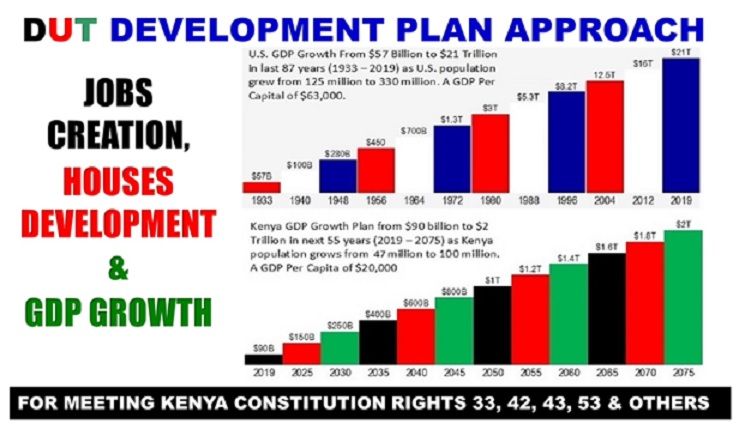

Kenya is today made up of about 52 million persons. Half of the population is considered to be the workforce of a County. Today we can say this is 26 million workers who can work at least 8 hours a day, 5 days a week and 250 days a year. This totals to 2,000 hours a person and 52 billion hours of time.

Kenya land is recorded as 581,000 square kilometers. This is about 145 million acres of land. Kenya land has billions of liters of water produced every day. Kenya land can produce food that can even feed a billion people every day, 365 days of the year. The Kenya land can produce materials for building good housing and roads for millions of families. The land can produce billions of trees that can keep the air clean as they remove the carbon.

The 52 billion hours of time and 145 million acres of land can produce the rights in the Kenya Constitution of food, healthcare, housing, clean water, clean and healthy environment, social security, education, children rights and other rights.

Kenya money as established by Kenya Constitution 231 is the third resource. The products of housing construction loans and mortgages should support GDP growth. This is achieved when money interest is in the single digits.

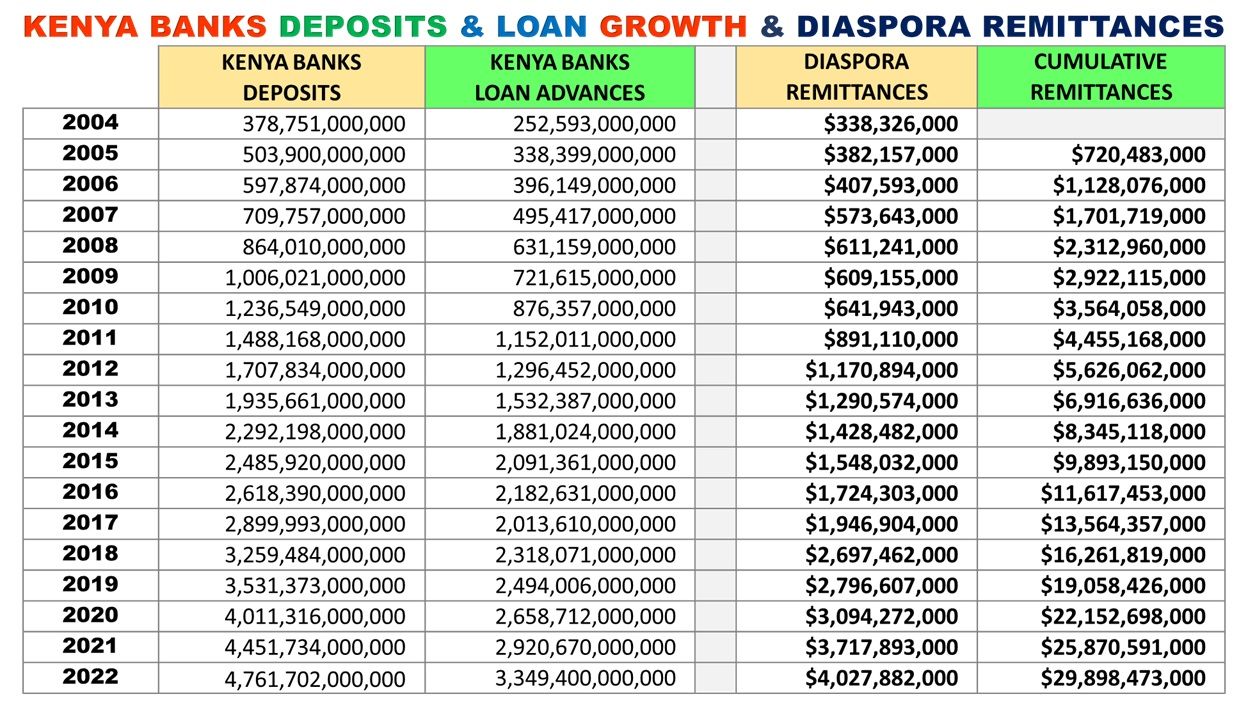

Can a Kenya Bank issue the DUT Ksh 44.5 billion mortgages?

Any Kenya bank interested to work with DUT based on the DUT system of GDP growth can issue the Ksh 44.5 billion mortgages. The biggest accelerator of banking in Kenya today is the world GDP through the Kenyans working and remitting money to Kenya. In the next 7 years Diaspora Kenyans will remit about $30 billion dollars. At an average of Ksh 140 exchange this will be about Ksh 4.2 trillion. The Ksh 44.5 billion can come from this amount and the bank working with DUT issues mortgages of 6,800 properties.