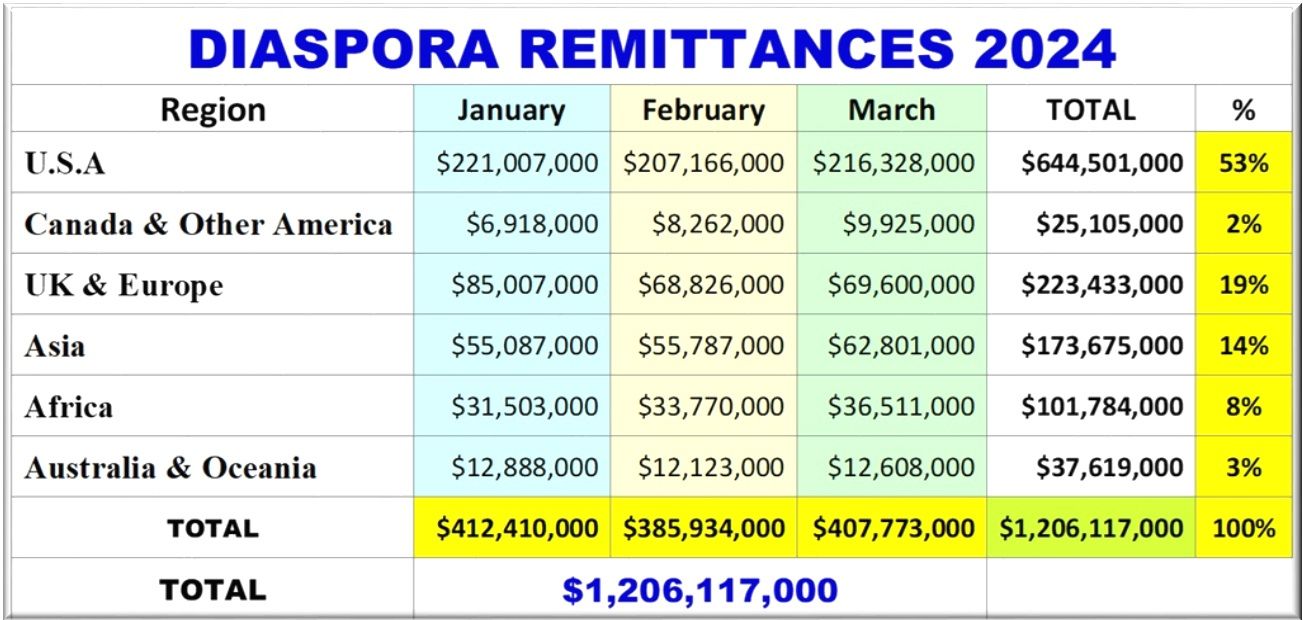

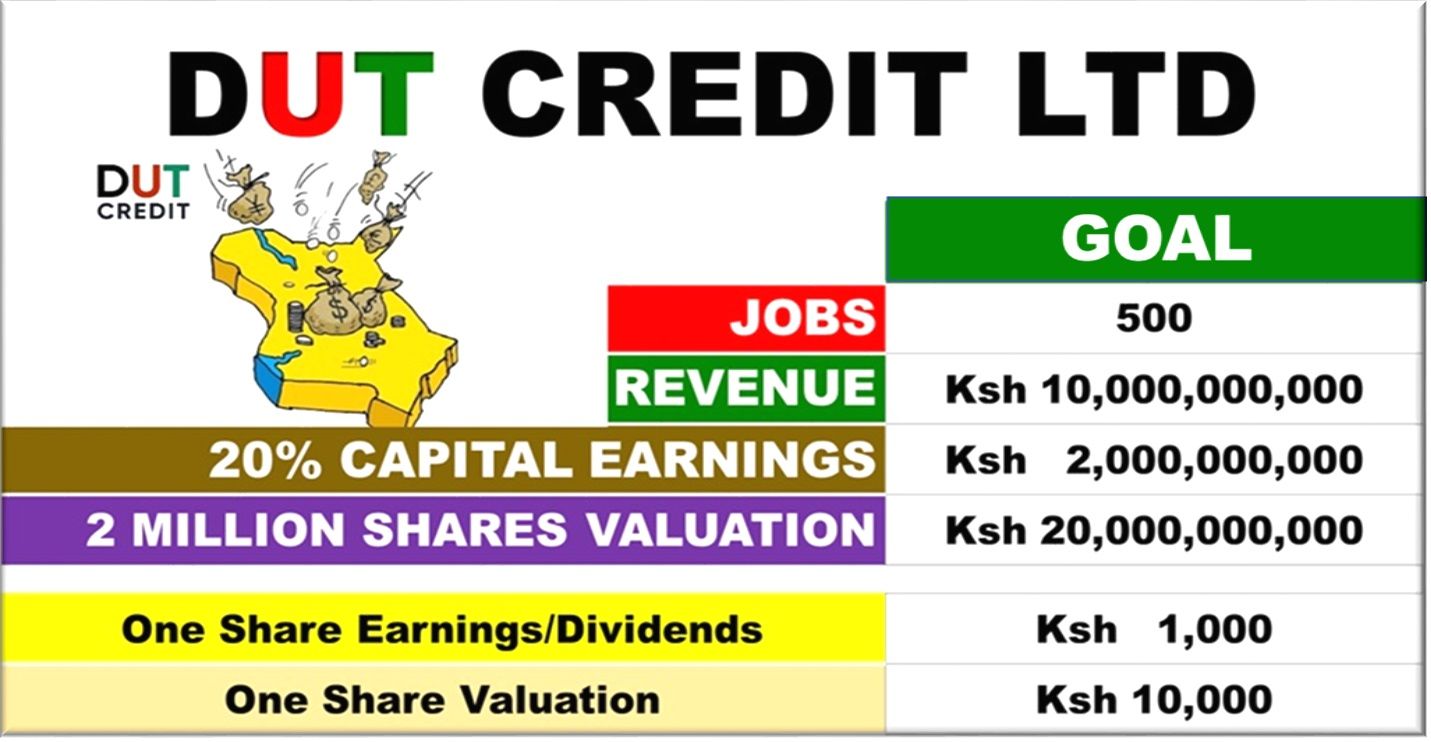

DUT Credit Ltd goal is to reach Ksh 10 billion revenue in the year the first Diaspora University class completes 4 years of studies. The DUT Credit Ltd systems and plans needed to achieve the goal are established. The DUT Credit Ltd, Voi team, is working toward the goal. The $1.2 billion Diaspora remittances in the first quarter of January- March of 2024 has ignited a debate that Diaspora Kenyans invest the $7 million capital DUT Credit Ltd needs to achieve the goal.

During the DUT Saturday meeting Dr. Jackson Waweru, one of DUT Credit Ltd investors challenged Diaspora Kenyans to invest in DUT Credit Ltd. From the estimated remittances of about $400 million in May 2024, $7 million could be investment capital into DUT Credit Ltd.

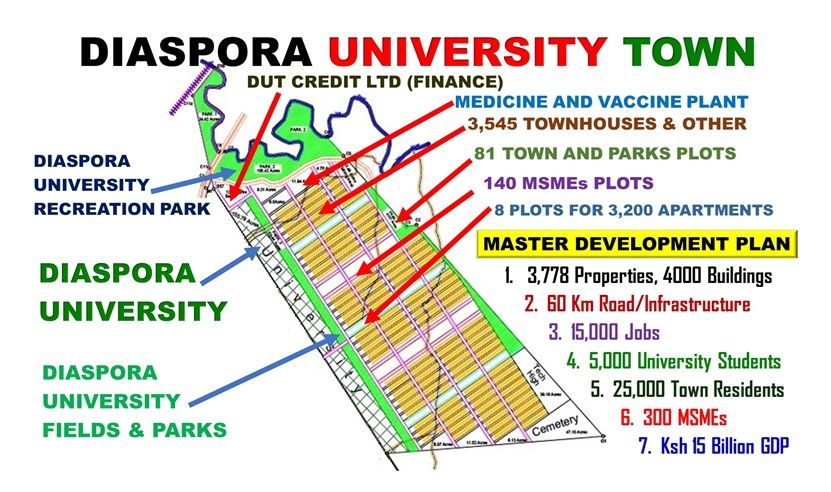

The Ksh 10 billion revenue goal will be achieved through the Diaspora University Town (DUT) jobs creation, housing development and GDP growth system. The DUT system when creating over 50,000 jobs, enrolling 5,000 students at Diaspora University and developing 20,000 housing units at DUT and DUT 47 project centers will generate loan products of over Ksh 120 billion.

The Ksh 10 billion revenue would be from the loans interest and other financial services income. 20% of the revenue, Ksh 2 billion would be the shareholders return.

The 15 financial opportunities DUT creates for DUT Credit Ltd are as follows:

1. DUT THIDA

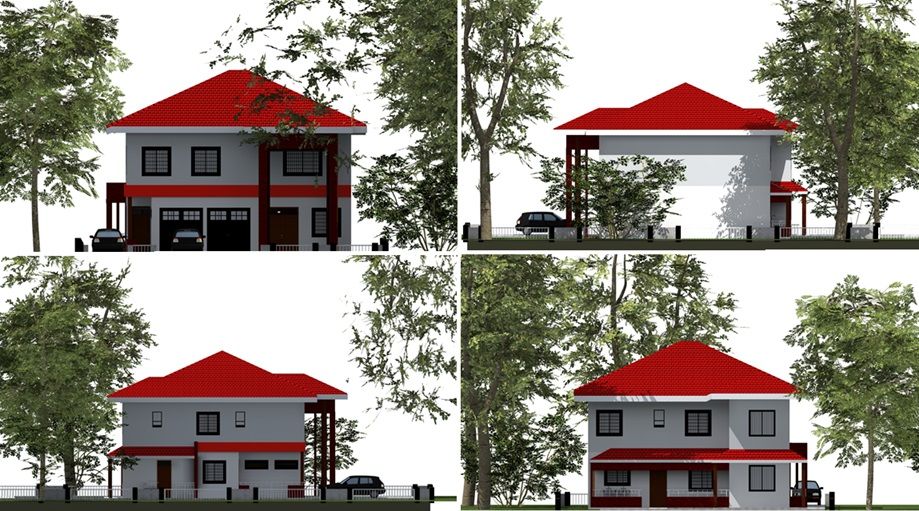

The DUT THIDA or Townhouse Developer system is a property development system that enables Diaspora Kenyans and Kenyans to become property developers. The first 3,500 properties to be developed by the system are on the 1,500 acres DUT land. DUT Credit Ltd is today issuing loans to Diaspora Kenyans and Kenyans who are becoming developers of the planned 3,500 townhouses. DUT Credit ltd plan is to issue about 2,000 loans of Ksh 500,000 to Ksh 2 million. The total loans issued Ksh 1.2 billion.

2. DUT DKTB MAVIS

Diaspora Kenyans and Kenyans through the Daktari Biotechnology Ltd. (DKTB) Medicine and Vaccines Investment Shares (MAVIS) are joining Diaspora Scientists to achieve a medicine and vaccine plant. DUT Credit Ltd is enabling persons to invest in building and equipping the medicine and vaccine plant. DUT Credit looks to issue about 5,000 loans of Ksh 200,000 – Ksh 2 million a total of Ksh 2 billion.

3. DUT MSMEs DEVELOPERS CAPITAL LOANS

DUT has 117 plots set aside for MSMEs. The MSME developers looking to build start their development through capital input for allocation of the plots. DUT Credit Ltd is issuing loans to those looking to have MSMEs properties. The total loans issued at Ksh 710 million.

4. DUT CONSTRUCTION LOAN

DUT Construction loan for building 3,700 properties at DUT through 300 contracts. The $7 million (about Ksh 1 billion) will go toward the DUT construction loan account. Through the Design-Build system the amount will produce the properties to be issued mortgages. The mortgage amount issued will be deposited back to the account.

5. DUT TOWNHOUSES MORTGAGES

The 3,500 townhouses produced at an average of Ksh 6.5 million will create a mortgage opportunity of Ksh 22.75 billion. Once DUT achieves the $7 million investment, DUT Credit Ltd will be able to advance to become a bank and through the DUT project establish the deposits to be applied in issuing the mortgages.

6. DUT DIASPORA UNIVERSITY MORTGAGES

Diaspora University will have 5 properties of the 3,778 DUT properties. The properties shall have buildings for education, recreation, fields and other facilities. The university will get about Ksh 5 billion mortgages.

7. DUT DIASPORA STUDENTS LOANS

In the first 4 years of the university operation, the DUT Master Development Plan (MDP) will grow Diaspora University endowment to Ksh 20 billion. From the endowment 5,000 students will be issued loans. DUT Credit Ltd will issue the loans of about Ksh 6 billion.

8. DUT DIASPORA UNIVERSITY HOSPITAL MORTGAGES

The Diaspora University medical hospital plan that will support the university will have buildings and equipment at DUT and the 47 DU project centers. The estimated credit needed to achieve the system is about Ksh 4 billion.

9. DUT TOWN PROPERTY MORTGAGES

The Diaspora University Town system is allocated 82 plots for the town parks, environment, security, administration, fire stations and others. About 10 properties will be built and issued mortgages of about Ksh 1. 5 billion.

10. DUT MSMEs MORTGAGES

As the 117 MSMEs properties have buildings added the properties completed will be issued with mortgages. The DUT Credit Ltd opportunity is about Ksh 15 billion.

11. DUT APARTMENTS MORTGAGES

3,200 apartments will be completed to be part of housing the 25,000 residents. The apartments will create a mortgage opportunity. DUT Credit Ltd plan is to issue mortgages to Diaspora Kenyans and those taking up some of the 20,000 jobs created. The mortgage opportunity is about Ksh 10 billion.

12. DUT 300 MSMEs BUSINESS LOANS

300 MSMEs setting up at DUT will need business loans for their stocks and equipment. DUT Credit Ltd sees an opportunity of about Ksh 3 billion.

13. DUT 15,000 WORKERS INDIVIDUAL LOANS

DUT 15,000 jobs creation and Ksh 15 billion GDP growth plans create an opportunity to give individual loans for housing furniture, house appliances, vehicles, motor bikes and others. The estimate is about Ksh 5 billion.

14. DUT PROJECT CENTERS PROPERTIES

Diaspora University project centers set up in 47 counties will lead to about 1,000 project plans completed in the first 4 years of Diaspora University operation. The project's plans will lead to about 30,000 new jobs created and 10,000 housing units developed. DUT Credit Ltd looks to issue mortgages for these properties that are estimated at about Ksh 30 billion.

15. DUT PROJECT CENTERS MSMEs

The project centers will lead to about 5,000 MSMEs that will create 30,000 jobs. Most of the MSMEs started at DUT will expand to the project centers. About Ksh 15 billion credit will support the MSMEs in job creation.

TOTAL CREDIT PRODUCTS

The total credit products opportunity for achieving Diaspora University and creating 50,000 jobs as per the 15 plans is over Ksh 120 billion. DUT Credit Ltd will reach the Ksh 10 billion revenue as it issues about 50% of the loans.

DUT Credit Ltd would be ready to list in the Stock exchange after achieving the Ksh 10 billion revenue and Ksh 2 billion net profit. The company valuation would be about Ksh 20 billion. The $7 million (about Ksh 1 billion) invested by Diaspora Kenyans would be valued at Ksh 7 billion. A growth of 7 times.

DUT Credit Ltd would thereafter start the second goal of reaching Ksh 100 billion revenue and Ksh 20 billion profit as Diaspora University, DUT Credit Ltd, DUT property developers and over 10,000 MSMEs pass the 1 million jobs creation mark and 500,000 housing unit’s development.

Dan Kamau a former Diaspora Kenya of Worcester, MA is the DUT Project Director. He can be reached via Email dan@dut.or.ke