Diaspora University Town (DUT) Property products and the Co-operative Bank finance products were discussed by: Bishop Donald Mwawasi of Atlanta, GA; Dorothy Mwawasi of Washington DC; Dan Kamau the DUT Project Director who is formerly of Worcester, MA; Faith Mwachala the DUT Property and MSMEs manager; and, Ruth Ngocho the Co-operative Bank Voi Branch Manager who was accompanied by Osman also of Co-operative Bank.

Personal Loan Product

The personal loan financial product offered by the bank is: Minimum loan amount of Ksh 50,000 and maximum loan amount of Ksh 8,000,000. Maximum term of up to 96 months. Purposes to be covered include education, medical, furniture, consumer durables, motor vehicles, plot purchase, holidays and shares.

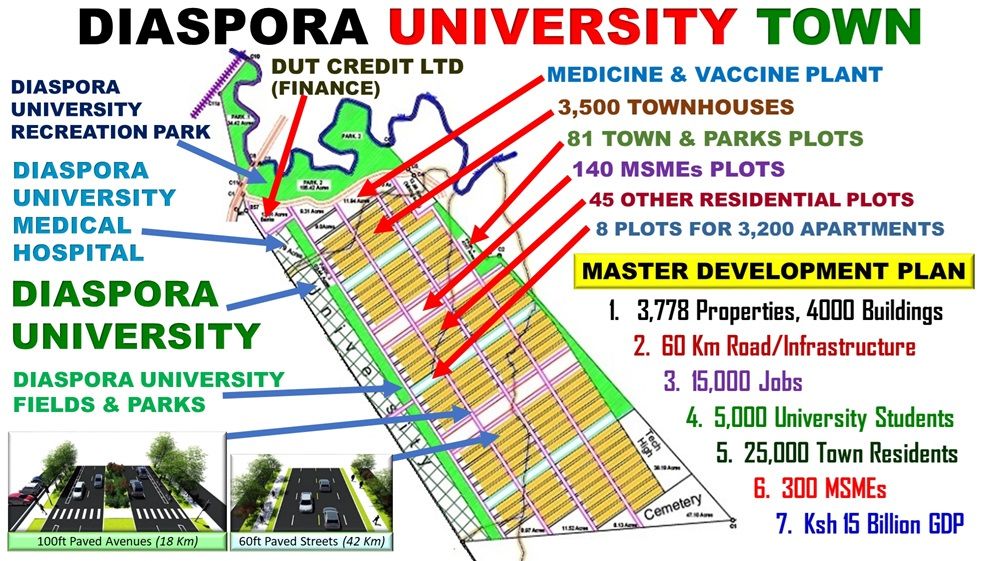

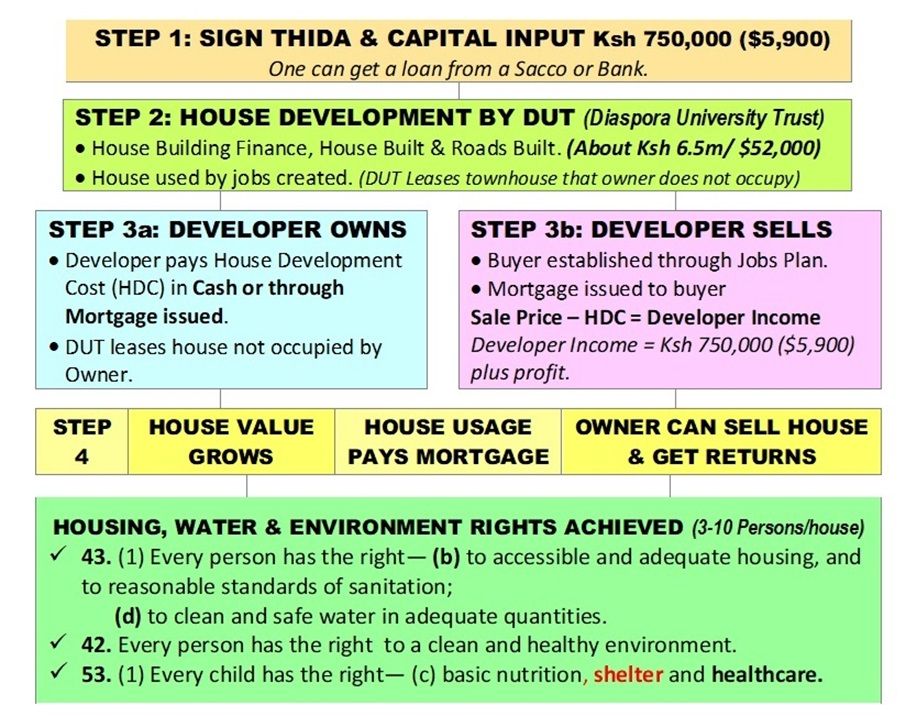

Dan Kamau said the financial product can finance DUT Townhouse Developer capital of Ksh 750,000 that is attached to a 50ft x 100ft townhouse development plot/plan. He said there are 2,200 units out of the 3,500 units, are available.

Dorothy & Bishop Mwawasi talking on behalf of the Diaspora Kenyans said the Diaspora Kenyans can take up more than 1,000 units through a finance loan of about $6,000. If one gets a loan for 96 months, the loan repayment would be about $100 a month.

Dan said that the personal loan would be closed once the townhouse is completed. He said the loan principal balance will be added to the house development cost and the owner of the house issued a mortgage of the total amount.

Construction Overdraft Loan

The second financial product discussed was the overdraft facility that would be issued to Diaspora University Trust.

The product as offered by the bank is: Interest payment is on what has been utilized. Loan may be repaid off at any given time without any penalties.

Dan presented the design-build that can be financed by an overdraft facility of Ksh 1 billion. He said the construction account would implement a detailed design-build plan. The money drawn from the account would pay for the completed certificate work.

He said the Construction account would progressively be replenished by the completed properties that are paid for in cash or through mortgages. Ksh 22.5 billion replenished from completion of 3,500 townhouses.

Townhouse Mortgage Loan

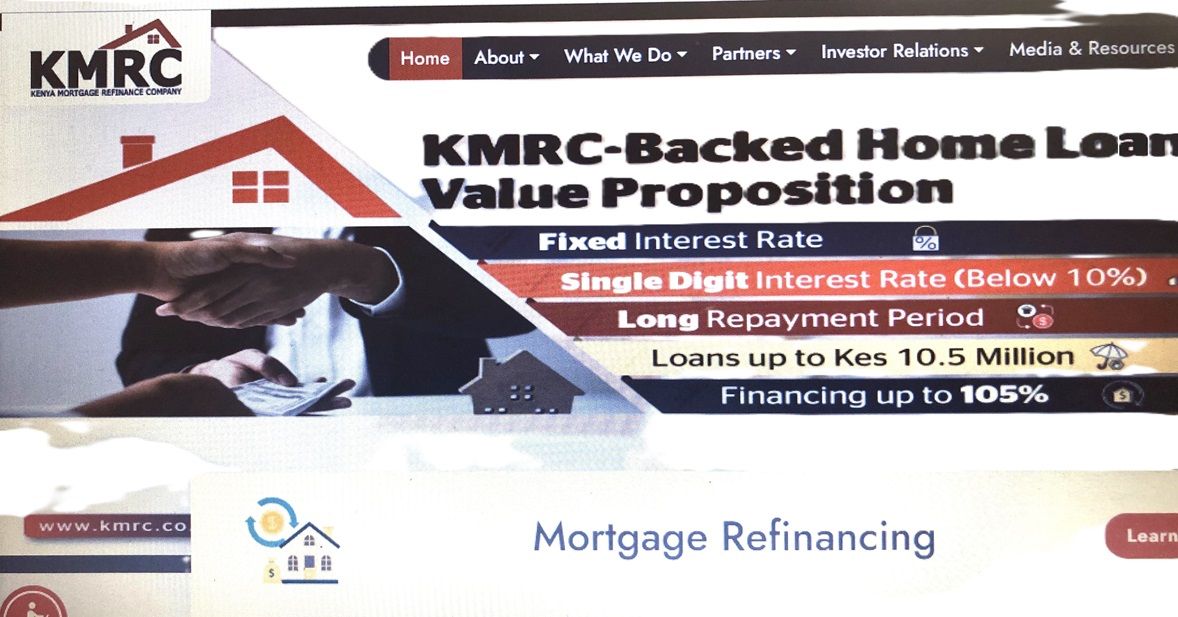

The townhouse mortgage loan was discussed based on the KMRC Mortgage. The mortgage is issued through one of the 20 primary mortgage lenders. Co-operative Bank of Kenya is one of the 20 primary mortgage lenders.

The product offered as established in the KMRC website is one with a fixed interest rate. Up to Ksh 10.5 million. Interest at single digit. Long repayment period and financing of up to 105%.

Dan said the KMRC mortgage product is perfect for DUT Townhouses. He said the townhouse's completion and sale price will not exceed 10 million. He said the finance will be part of creating 20,000 jobs and meeting the right of housing for over 15,000 persons.

The 3,500 units would be completed in about 5 years and the estimated finance at about Ksh 24 billion mortgages would be issued.

Business Property Mortgages

The Co-operative Bank Product considered was one offered as: Competitive interest rates; Affordable instalments with a repayment period of up to 20 years; The house you purchase can be used as collateral and its rental income can be used to repay the loan

The MSMEs and Diaspora University Trust can borrow this product as their properties are completed.

Benefits

Ruth said that Co-op bank also looks at the benefits to the communities and will assess the project on risks. She said the bank wants to be part of a successful project.

Some of the benefits in the DUT project are: Jobs that lead to persons having food in line with Kenya Constitution economic, social and children rights.

The townhouses will benefit Kenyans as they meet the rights of housing and water in Kenya Constitution 43 (1) Every person has a right to (b) to accessible and adequate housing, and to reasonable standards of sanitation. (d) to clean and safe water in adequate quantities.

The DUT development plan will also meet the Kenya Constitution 42 Right of clean and healthy environment through paved roads, wastewater waste management, storm water management, waste management plan and other systems that will be implemented collectively as established in the Strategic Environment Assessment approved by NEMA.

Bishop Mwawasi who took the Institution Town Development Plan to the Taita Taveta County for approval and thereafter engaged Ndara B Community was happy with the discussion. He said Taita Taveta is close to achieving the development plan of jobs creation that Diaspora Kenyans and Ndara B Community are the main investments. He said before he returns to the U.S he will put time to see the finance plan is achieved so young men and women can get opportunity.

Faith Mwachala, a Gen Z speaking on behalf of her fellow Gen Z said her generation is ready. She said the plans are ready and thousands of young men and women are ready to build the town and houses.

It was agreed that a detailed document that can be implemented be established. The document would cover all aspects and once ready would be the implementer of the project.

Dorothy Mwawasi, a DUT Townhouse Developer in her role as a townhouse developer, an investor and job creator; accompanied the bankers to open a bank account at the Voi branch. She said she will play her role so jobs are created as fast as possible so young men and women can benefit from the jobs and have a future.