About 50% of Diaspora Kenyans in the U.S., U.K., Europe, and other parts of the world work in the healthcare sector. Many are nurses who administer medicine. Dr. Wilson Endege of Boston, MA, welcomes Diaspora Kenyan nurses to become Daktari Biotechnology Ltd angel investors and contribute to producing medicine and vaccines for Kenya.

When presenting the opportunity, he showed fifty (50) of the biggest pharmaceutical industries' market capitalizations, which ranged from $15 billion to $580 billion, with a total valuation of $4.7 trillion. The scientists and the angel investors will grow Daktari Biotechnology Company to a market valuation of $1 billion (Ksh 120 billion) in about 10 years.

Dr. Endege is a Diaspora Kenyan who has lived and worked in the pharmaceutical sector, in academia at Harvard University, Chiron Diagnostics Inc., Millennium Pharmaceuticals Inc., and AstraZeneca Pharmaceuticals.

Five other scientists joined him in founding Daktari Biotechnology Ltd. Three are Diaspora Kenyans: Dr. Patrick Shompole of Pullman, WA; Dr. Benson Edagwa of Omaha, NE; and Dr. Bernard Ayanga of Houston, TX.

The company plans to produce medicines and vaccines in Kenya and open pharmacies. The Diaspora Kenyans' role as angel investors is to provide capital for building the plant, starting the production, and opening pharmacies. The capital set is $12 million, to be put in through 60,000 investments of $200/Ksh 25,000.

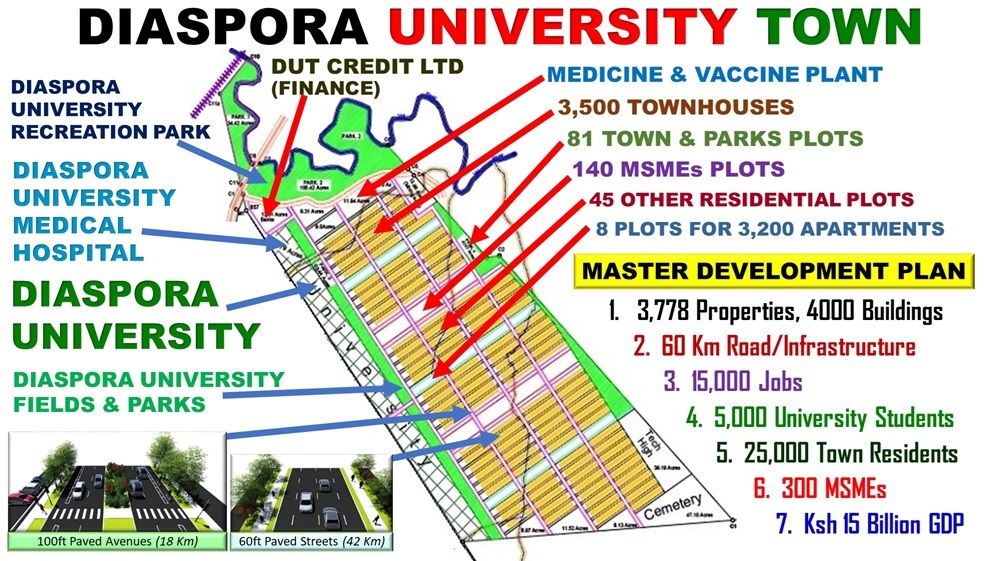

Diaspora University Trust has invested in four plots and capital that have started the Medicine and Vaccines development plan at Diaspora University Town. The Daktari Biotechnology Company plan is also integrated with the Diaspora University plan, the Diaspora University Medical Hospital plan, the Diaspora University Town plan, and the Townhouses Development Plan.

The $12 million angel investor capital will be used to construct the medicine and vaccine plant, purchase and install equipment, conduct clinical trials, manufacture drugs and vaccines, and open pharmacies. This capital will also help create about 1,000 jobs in the plants and pharmacies.

The $12 million will contribute to growing Kenya's GDP. As Kenya's GDP grows and medicine and vaccine consumption increase, the $12 million capital is projected to grow to $90 million as the company grows its valuation to $300 million in about five years. This means every $200 invested will increase in value to $1,500. This growth will be achieved as a new market of medicines and vaccines emerges from the Kenyan and African GDP growth.

According to the plan, as the company's revenue reaches $200 million, each $200 invested would yield $100 in dividends. The goal is to reach the revenue and dividends by the end of the fifth year after investment. Thereafter the goal is to sustain a minimum dividend of $100 every year.