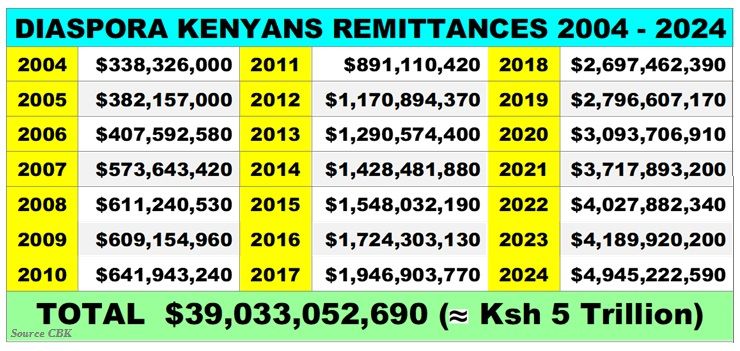

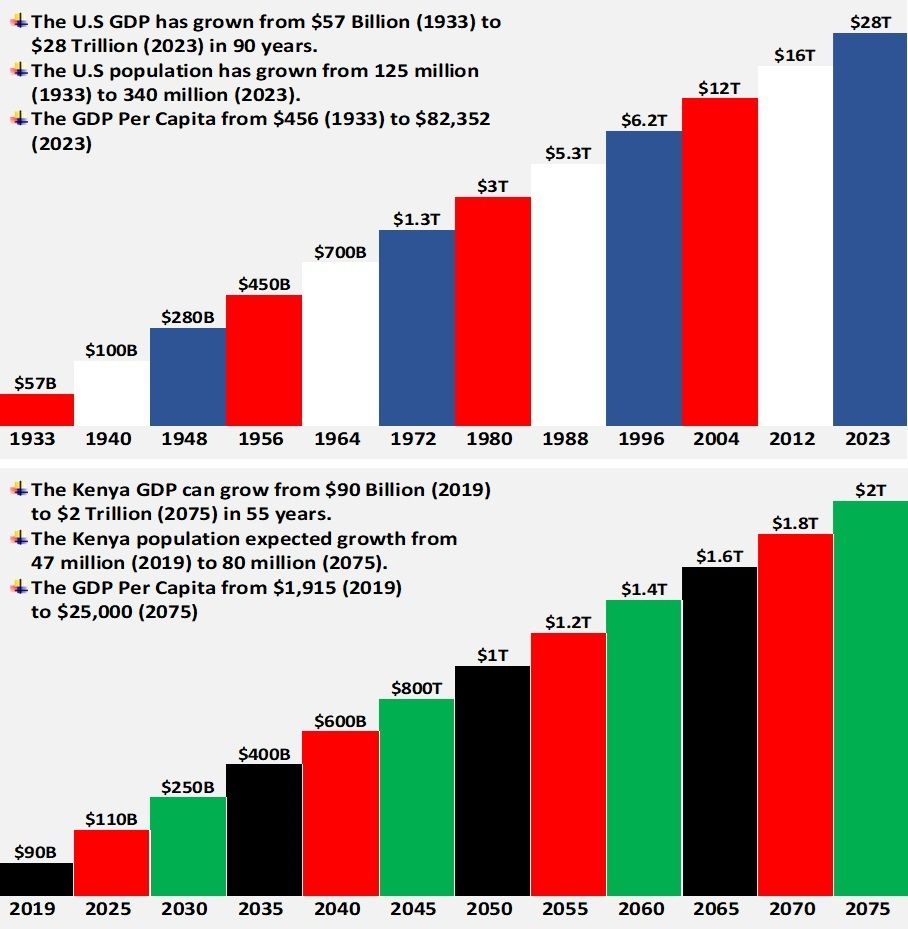

Diaspora Kenyans' remittances in 2024 were $4.9 billion. The total amount remitted from 2004 to 2024 is $39 billion (about Ksh 5 trillion). If the Diaspora Kenyans had established the angel investment system in 2004, and $2 billion of the $39 billion invested in Micro Small & Medium Enterprises (MSMEs), Kenya's's GDP would be over $1 trillion, and the $3.9 billion would be valued at over $500 billion in property and businesses. Today, Diaspora Kenyans can invest $50 million to grow to $500 million in 5 years through 16 companies started at Diaspora University Town (DUT) as they become founder angel investors.

My name is Dan Kamau. I lived in Worcester, MA, where, with WPI professors, we started what is today the Diaspora University Town (DUT). As the Diaspora University Trust – Executive Trustee and the DUT project director, I’m implementing the DUT Master Development Plan (MDP).

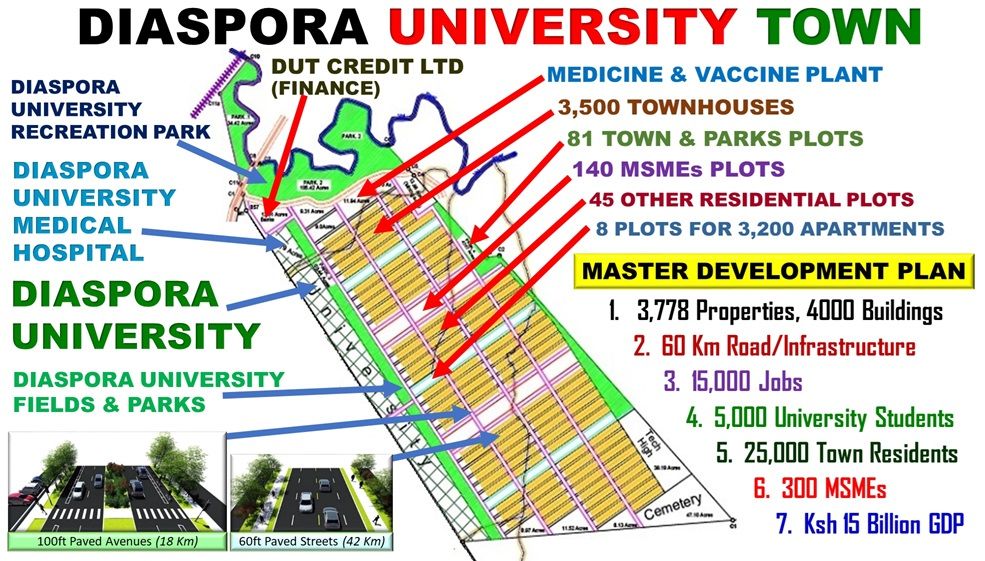

The DUT-MDP will achieve a town with: a non-profit university with a level 5/6 medical hospital, over 300 Micro Small and Medium Enterprises (MSMEs), and 3,778 university, town, residential, and commercial properties.

The developed town's estimated new wealth will be over $2.5 billion. Diaspora University will have assets of about $300 million. Individuals who own 6,745 residential properties will have $700 million of new wealth. The MSMEs/Organizations in the town capital will have a value of about $1.5 billion. The $500 million new wealth created from $50 million will be reflected in the MSMEs' $1.5 billion.

The DUT-MDP uses a GDP growth approach to make human, land, and money resources productive. To my fellow Diaspora Kenyans, a $50 million opportunity is available through 250,000 investments of $200 (Ksh 25,000) that will be issued shares in 16 MSMEs.

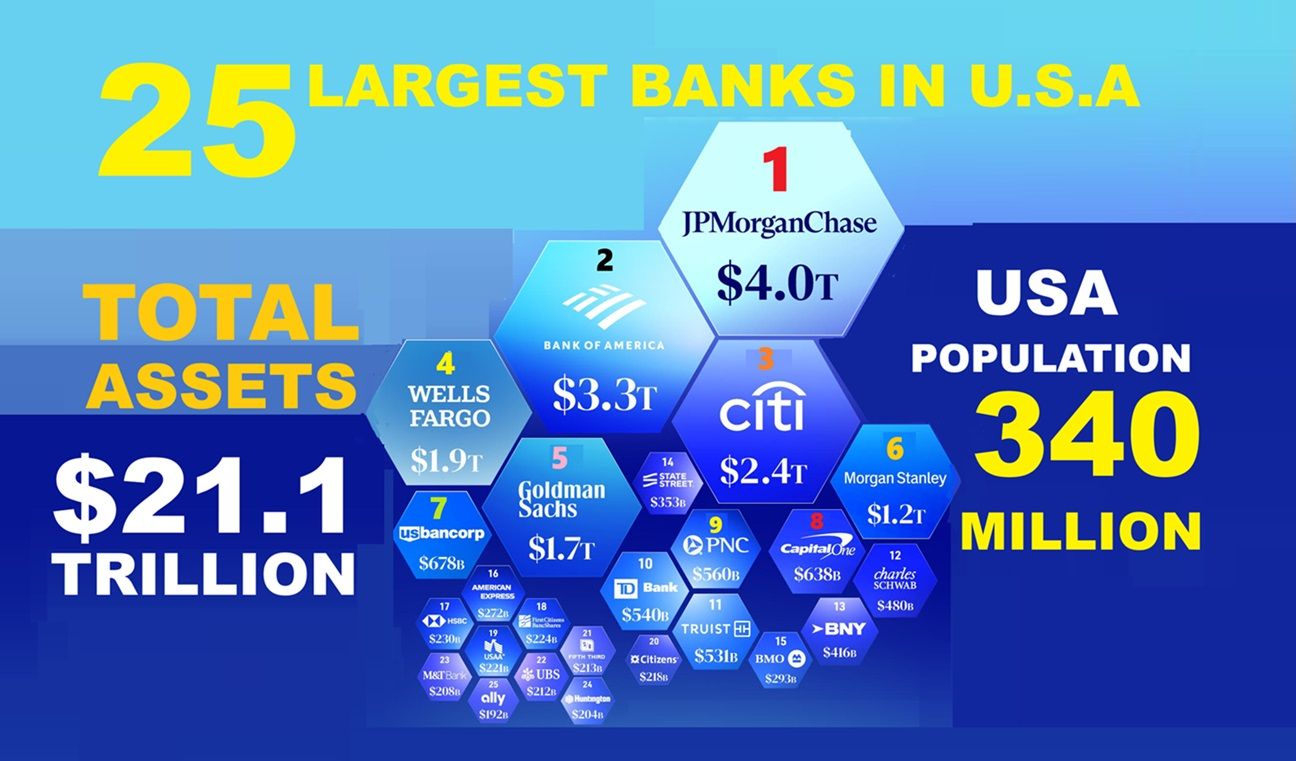

We are investing as angel investors. An angel investor is an individual who invests capital into a business's share capital. The main goal of investment is to produce products and services that sustain humanity and the environment and make a return. About 400,000 angel investors in the U.S. invest about $30 billion in startups yearly.

The $50 million invested in 16 DUT MSMEs will produce goods and services for Kenyans' consumption. After the investment, the companies' revenue is projected to reach $1 billion by year 5. The $50 million valuation would grow to about $500 million. The $50 million capital return through dividends would be about $50 million from year six.

While the DUT MSMEs will be new, the products, revenue, and return systems are not new. As shown in their GDPs, they have already been implemented in developed countries. The DUT GDP growth system approach will support the companies with revenue and minimize capital risk.

Daktari Biotechnology Ltd - $12 million angel investment www.dktb.co.ke

Founded by Dr. Wilson Endege and other Diaspora Kenyans, the company will produce medicines and vaccines and open pharmacies. It will work closely with Diaspora University and the Diaspora University Medical Hospital.

The DUT plan is for the company's revenue to grow and reach $200 million by year 5, when the first four-year class of Diaspora University graduates are enrolled.

Fifty of the biggest pharmaceutical industries have a market capitalization ranging from $15 billion to $580 billion, with a total valuation of $4.7 trillion.

DUT CREDIT LTD. – $8.4 Million Angel Investment. www.dutcredit.co.ke

DUT Credit Ltd. was founded in 2020 by Diaspora University Trust, Diaspora Kenyans, and Ndara B Community members. The company has been allocated a three-acre plot at DUT to build its property.

Once the company gets the investment, as part of the DUT Master Development Plan, the company's revenue will grow to about $90 million by the end of year 5. The $200 investment will grow to about $2,000 and earn dividends of $100 or more yearly.

DUT DESIGN-BUILD COMPANY - $4 million angel investment https://dut.or.ke/design-build

This design and building company's set-up location is on a 9-acre plot at DUT. The company will design and build the Diaspora University Town and execute the DUT construction work of about $316 million (Ksh 39.5 billion).

The company plan mirrors that of the top 20 U.S. design-build companies, which in 2023 had construction revenues totaling $61 billion, ranging from $1.4 billion to $8.2 billion.

The DB Company's target is to reach a yearly revenue of $300 million by year 5 and issue dividends of $20 million from this revenue. The company will work closely with the Diaspora University School of Engineering and the Project-Based Learning Center.

Over 10 Design-Build professionals are founding the company.

DUT TOURISM HOTEL Co. - $4 million angel investment

The DUT Tourism Hotel Company will implement a 500-room hotel development on 3 acres of land at DUT and a 1 million international tourist plan. The hotel will be built adjacent to the 139-acre Diaspora University Recreation and Water Park.

The founding professionals are: Frank Mutura of Raleigh, NC (Hotel) and Cathy Jackie Mutahi of Baltimore, MD (Tourism Plan)

The company aims to reach $100 million in revenue with $10 million in dividends issued. The $4 million in year 5 will be valued at $40 million, and $2 million will be received from the $100 revenue achieved.

DUT BUILDING MATERIALS CO. $4 million angel investment https://dut.or.ke/dut-materials

The company's plan to produce building materials for the DUT's $316 million Design-Build budget has started. The company will earn about $15 million from product supply and another $3 million from material management services from this budget.

The company is allocated two plots at DUT. The lead founders are Ronald Mwangombe of Voi, Kenya, and Jackson Kimanzi, formerly of Worcester, MA.

The company aims to reach $1 billion in sales in less than 10 years as it works closely to produce and sell building materials throughout Kenya.

To achieve this goal, the company will work closely with the DUT Design-Build Company, Diaspora University, and DUT Credit Ltd.