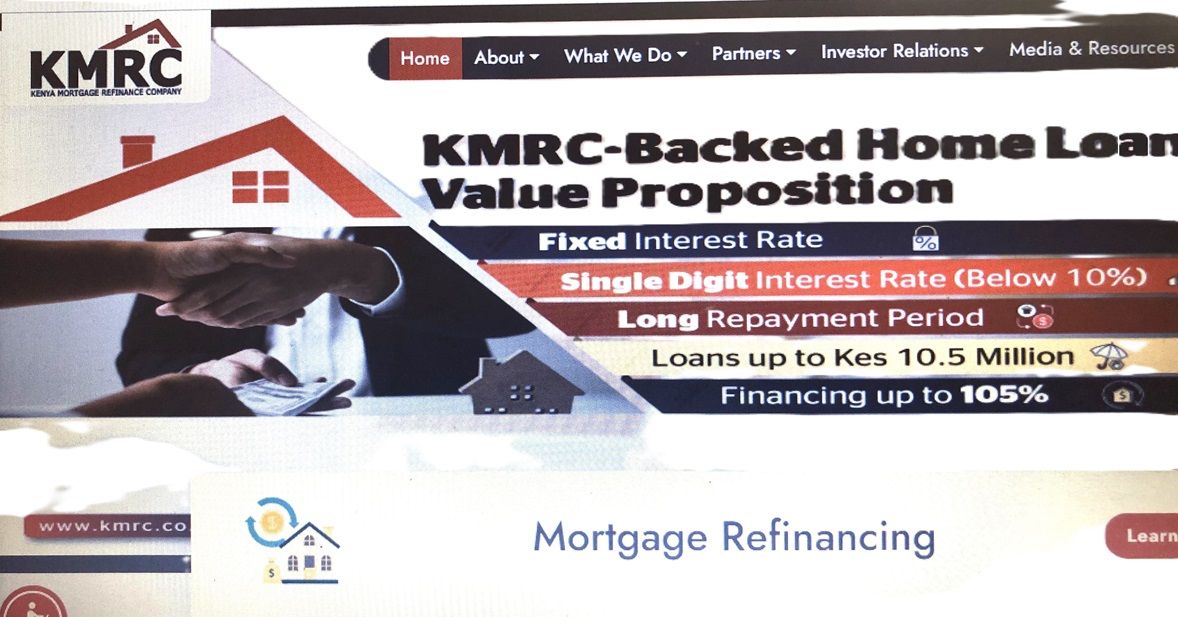

In 2018, the Kenya Mortgage Refinance Company (KMRC) was established as a non-deposit taking financial institution. The shareholders include the Government of Kenya, 20 financial institutions, the World Bank, and Shelter Africa. The KMRC mandate is to provide long-term funds to primary mortgage lenders (PMLs) to increase the availability of affordable home loans to Kenyans.

According to the 2023 financial statement report, KMRC has credit lines of €90 million from the African Development Bank (AfDB) and €291.4 million from the World Bank (WB). This totals to €291.4 million, approximately Ksh 40 billion.

By 2023, Ksh 20.6 billion of the Ksh 40 billion credit line had been drawn. Ksh 8.4 billion was advanced to primary mortgage lenders (PMLs), and Ksh 11.2 billion was held in cash. By the end of 2024, the credit line drawing had grown to Ksh 25.7 billion, loans to PMLs had increased to Ksh 11.8 billion, and the cash in hand had risen to Ksh 14 billion.

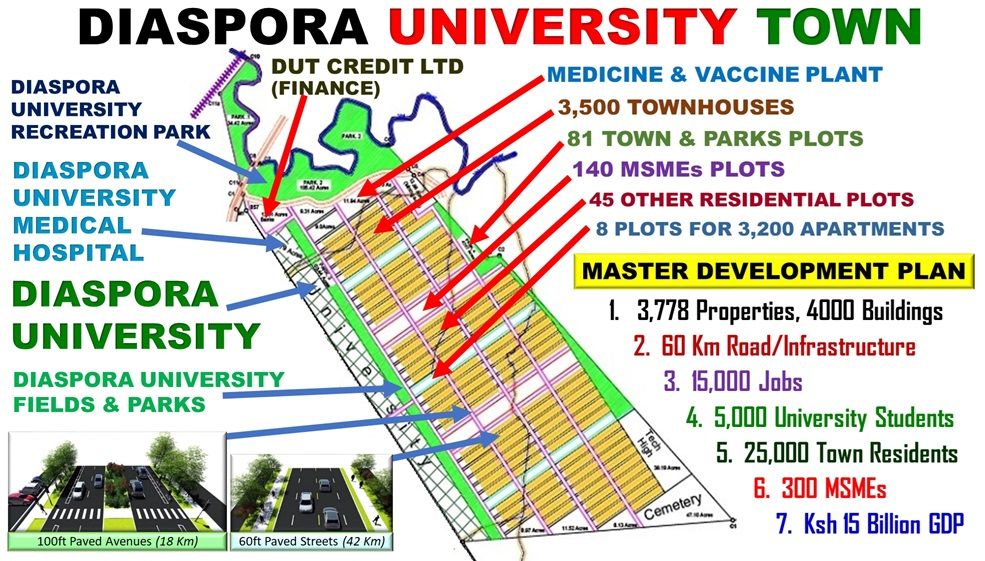

At the start of 2025, there was Ksh 29 billion available for mortgage loans. This comprises Ksh 15 billion in undrawn credit and Ksh 14 billion in cash. Diaspora University Town (DUT) founders are working to tap this money and meet the housing need through their job creation, house development, and Gross Domestic Product (GDP) growth plan.

Dan Kamau, the DUT project director, compares KMRC's finances to those of Fannie Mae and Freddie Mac. He states that these two U.S. institutions, which currently hold approximately $7.5 trillion in mortgage assets, have facilitated the financing of over 50 million housing units in the United States. They have also contributed to the growth of the U.S. banking sector, which today comprises the 25 largest banks in the country with $21.1 trillion in assets. He adds that KMRC will play a significant role in facilitating the housing needs of Kenyans, as well as contributing to Kenya's GDP growth.

The DUT housing plan, comprising 6,700 housing units, 3,500 townhouses, and 3,200 apartments, will utilize the KMRC financial resource to meet Kenyans' constitutional rights, as outlined in Articles 42, 43, and 53, regarding housing, environment, clean water, and child shelter.

Dan says the current plan he is working on is for the development of the first 200 townhouses, which will be issued mortgages by KCB Bank as the primary mortgage lender. The 200 townhouses are being developed by 200 Diaspora Kenyans who have invested their capital. The Diaspora University Trust is organizing the development, and KCB Bank will provide the finance. The 200 Diaspora Kenyans are currently opening accounts or updating accounts at KCB Bank.

The 200 townhouses will be completed in batches of 20 through a production line system. Upon completion, the houses will be issued mortgages. The budget for developing the 200 townhouses is approximately Ksh 1.3 billion. This constitutes the construction cost at 93% (Ksh 1.2 billion) and the development and construction finance cost at about 7% (Ksh 100 million)

Upon completion, each of the 200 houses will be issued mortgages through the finance product, which offers 105% financing of up to Ksh 10.5 million, with a 9.5% interest rate and a 25-year tenor, as established by KCB and KMRC. The 200 Diaspora Kenyans developing the houses will either own the units or sell to those taking up the jobs created at Diaspora University, the Town, the Hospital, and the MSMEs and Organizations setting up.

Ronald Mwangombe, who is spearheading the production of building materials, has started the plan for building materials production. As the 200 Diaspora Kenyans' accounts are open, the Ndara B Community will activate their 16 Micro, Small, and Medium Enterprises (MSMEs). The MSMEs will supply materials worth approximately Ksh 500 million, accounting for about 41% of the Ksh 1.2 billion construction budget.

Approximately 3,000 jobs are expected to be created by the Ndara B MSMEs producing building materials. An additional 2,000 jobs will be created at the DUT construction site.

Dan is pleased that bankers are working to have the Ksh 29 billion reflected as loans issued as quickly as possible. He states that the DUT goal is to complete 3,500 townhouses and 3,200 apartments by 2030. He adds that the KMRC finance of approximately Ksh 35 billion will be applied as banking assets grow by Ksh 35 billion. Most important is that approximately 7,000 families, comprising around 25,000 people, will have their constitutional rights of housing, clean water, and a clean and healthy environment achieved at the Diaspora University Town (DUT).