KCB Bank visited Diaspora University Town (DUT) to open bank accounts for persons working in the DUT plan and the Ndara B Community MSMEs plans for building materials and farming businesses. Some of those who opened accounts said it was their first time. Dan Kamau, the DUT project director, said, “The bank account is for receiving pay and for borrowing.” He added that the newly opened bank account will record payments for completed work.

The KCB Bank team also used the opportunity to present several account-opening products outlined on the KCB website.

The Transactional Account and Salaries Account were presented as current accounts for receiving income and money. When money is deposited into the account, the money can be withdrawn at any time by phone, with the money transferred to the customer's M-Pesa account. One can also download the KCB Bank app and manage their banking from anywhere. These accounts do not have interest.

The other account presented was the savings account. The main product presented was the KCB Simba Savings Account, introduced as a secure and flexible savings solution that helps customers grow their money while earning competitive interest rates. The minimum balance is Ksh 1,000. Savings of Ksh 1 to 100,000 earn 4% per year; savings of Ksh 100,000 to 500,000 earn 4.5% per year; savings of Ksh 501,000 to 1 million earn 5%; Ksh 1 million to 10 million earn 6%; Ksh 10 million to 20 million, 6.5%; and above Ksh 20 million, 7%.

The bankers asked their new customers to cultivate a savings culture as a foundation for future borrowing. The key feature of a savings account is that withdrawals are limited.

The discussion then progressed to credit and loan products available once one has a bank account and maintains deposits.

The first loan product to explore is an unsecured personal loan of Ksh 20,000 to Ksh 8 million, repayable over 49 months. For salaried individuals working in the government or companies with which the bank has an agreement, one can access an unsecured check-off loan of up to Ksh 10 million, repayable over up to 120 months (10 years).

The team also discussed KCB M-PESA Loans and Mobile loans, available through the mobile app or USSD service, ranging from Ksh 50 to Ksh 1 million.

The bankers also highlighted asset-financing loans, which are secured by the asset. The loans are secured by assets such as vehicles, machinery, household appliances, and other assets. The loans are based on the asset's value and its expected life.

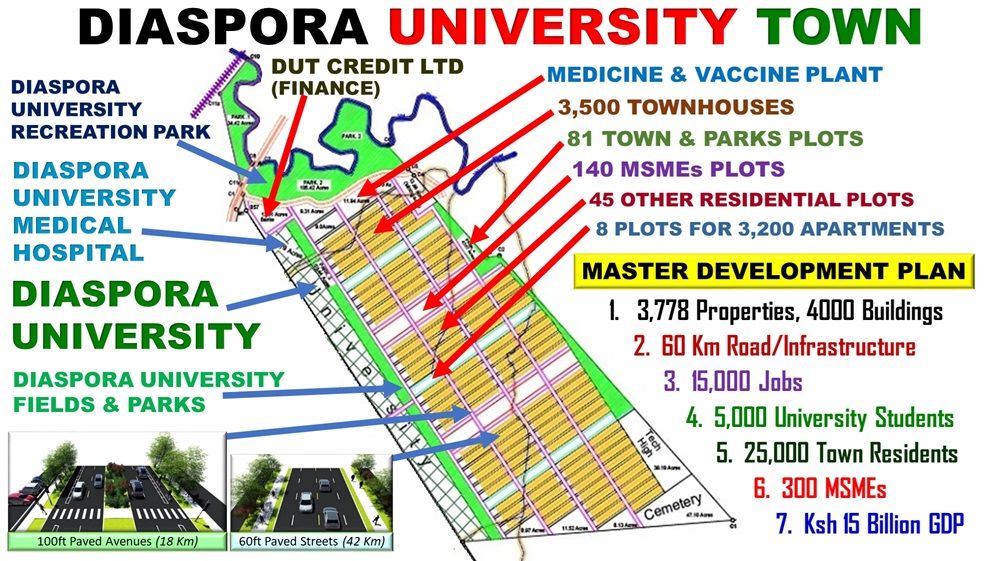

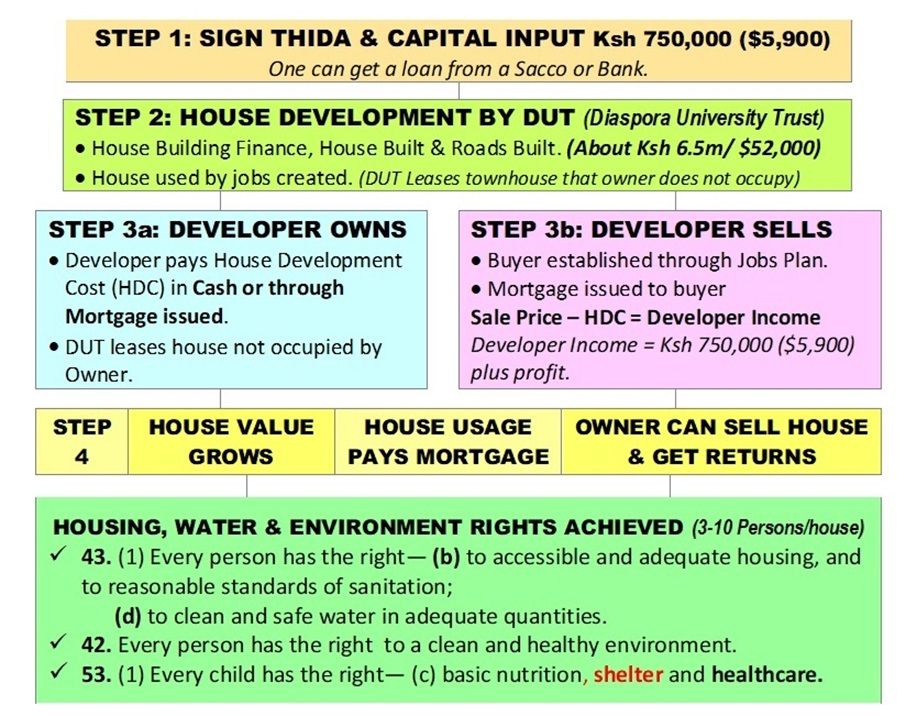

The other product is the Mortgage product offered for the completed housing units. DUT's goal is to have 3,500 townhouses and 3,200 apartments completed by 2030. Currently, the best mortgage loan product is the Kenya Mortgage Refinance Company (KMRC) loan, available up to Ksh 10.5 million at 9% interest and a 25-year tenor. The product is currently offered through 27 banks and Saccos. KCB Bank is one of the banks.

Dan said the goal of DUT is to ensure that those opening accounts receive their pay through those accounts. He advised them to use a single account to consolidate their data for loan applications. Dan said that about 1,000 of the 3,500 townhouses will be allocated to those opening accounts as DUT progresses, creating jobs.

He said that, through the DUT plan, one can, in 2030, have a portfolio of account balances in the current account (transactional or salary) totalling Ksh 10,000. A Car Asset loan balance of Ksh 1 million and a DUT townhouse valued at about Ksh 10 million, with a principal loan balance of Ksh 6.4 million.

Dan, when thanking everyone who opened accounts, presented the story of how three banks in Singapore have $1.4 trillion in assets and rank among the 100 largest banks in the world. He compared the banks to the Kenyan banks that have about $60 billion (Ksh 7 trillion)

Kenya's total land area is 580,367 sq km, making it the 48th-largest country. The population is estimated at 53 million, placing Kenya at number 28 among the most populous countries, yet Kenya has no banks in the top 100.

Dan said that what is being started today will increase bank assets, as the DUT plan and Ndara B Community plan gradually make over 100 million hours from 20,000 persons, and millions of tonnes of natural materials. He said these new bank assets will be housing mortgage loans.