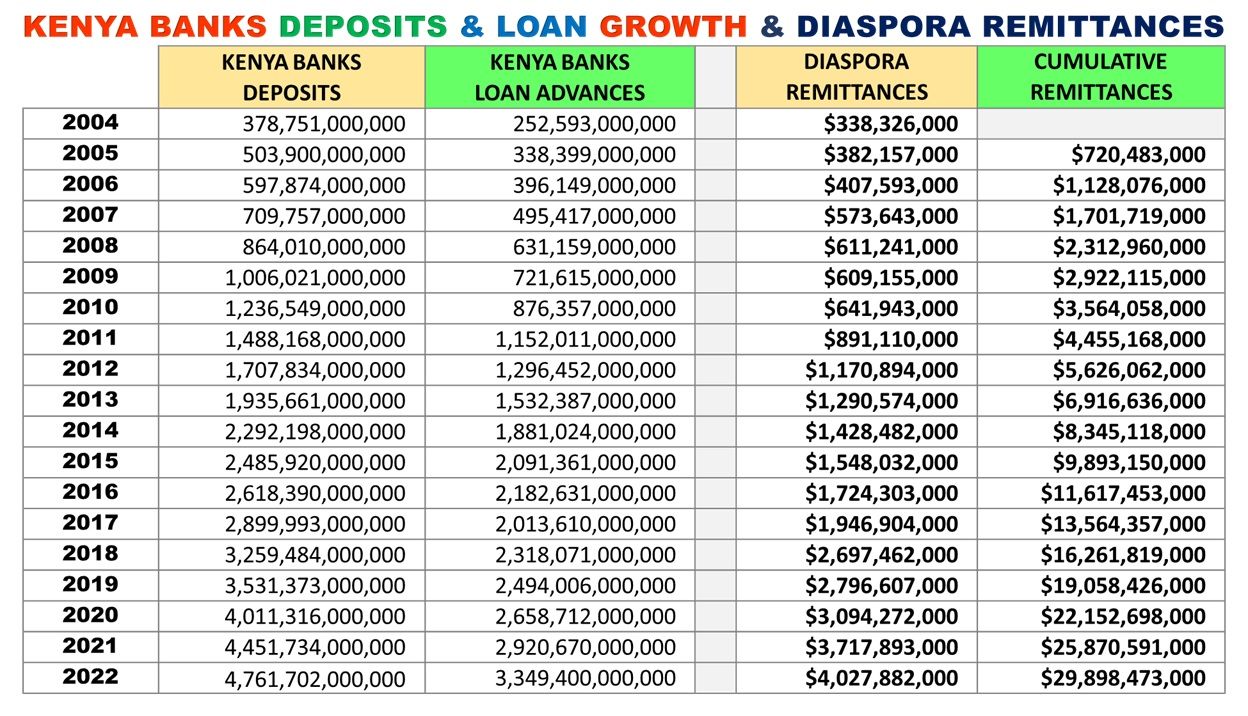

From 2004 to 2022 Diaspora Kenyans remitted $29 billion (about Ksh 3 trillion). During the same period the Kenya deposits grew from Ksh 378 billion (2004) to Ksh 4.7 trillion (2022). The loan advances given by the banks from the deposits grew from Ksh 252 billion (2004) to Ksh 3.3 trillion (2022).

Based on the over $4 billion remittance in 2022, the projection is that the Diaspora remittances in the next 5 years will be over $20 billion (about Ksh 2.5 trillion). Diaspora Kenyans who are working on the Diaspora University Town (DUT) project are looking to partner with a bank interested in having $500 million (about Ksh 70 billion) of the projected $20 billion come through the bank.

Dan Kamau, the Diaspora University Town (DUT) project director, answered a few questions on this.

What is the Diaspora Kenyans $500 million DUT-Bank Partnership?

This is a partnership plan that would aim to have $500 million remitted by Diaspora Kenyans come through the bank as well as be applied in the Diaspora University Town (DUT) project in the next 5 years. The $500 million is based on the fact that Diaspora will remit about $20 billion in the next 5 years. The $20 billion is based on analysis of the remittances from 2004 to 2022.

Why are Kenyans remitting their money to develop DUT?

Kenyans are remitting money to develop DUT based on the DUT jobs creation and house development plan. Diaspora Kenyans money comes from the jobs created abroad. It is based on this that the DUT plan approaches the project based on jobs creation.

How will the $500 million grow bank deposits and loan advances?

Diaspora Kenyans founding the project will progressively make deposits into the bank accounts they open at the bank willing to partner with them. The remittances will grow the deposits and loans as those deposits become townhouses, apartments and other property in DUT.

How many Diaspora will open accounts?

The number of Diaspora will be based on the property development and investment opportunities at DUT. We have 3,500 townhouse investment opportunities, 3,200 apartment’s opportunities, and 300 MSMEs. Currently we have about 500 Diaspora Kenyans advancing the development of DUT townhouses. These Diaspora Kenyans will open accounts. As we partner with the bank we expect to grow the numbers.

How will the Diaspora benefit from putting $500 million into Kenya through DUT and Bank?

The Diaspora Kenyans will benefit from their money growing in value. In the bank the money will grow in value through deposits interest. The DUT system will grow the money value through jobs creation, property development and opening of MSMEs at DUT.

The $500 million will grow to about $700 million in 5 years. The Diaspora Kenyans benefit will be about $200 million. The benefit will be reflected in the property ownership value, MSMEs shares value and balances in the individual bank accounts.

Tell us about the property development plan?

The DUT property development plan will lead to 3,778 properties. The property development budget is currently set at Ksh 44.5 billion. This budget will be financed by the DUT Ksh 50 billion deposits plan. The $500 million remittances plan will be one of the sources of the deposits. The Ksh 44.5 billion properties development budget will finance the Ksh 38.3 billion Design-Build plan. DUT will oversee the development in accordance with the DUT – Strategic Environmental Assessment (SEA) that was approved by NEMA.

Tell us about the Design-Build plan?

DUT design-Build plan is an estimated Ksh 38.3 billion plan that will produce the townhouses, apartments, university properties, town properties, MSMEs properties, and the roads/infrastructure to service the properties. The current budget breaks the payments as Ksh 10.7 billion to Ndara B material plan; Ksh 11.5 billion to the jobs at DUT and Ksh 16.1 billion to other materials/MSMEs budgets.

Will the Ksh 38.3 billion grow the Ksh 50 billion deposits?

Yes. The Kshs 38.3 billion will grow the deposits of the bank partnering by about Ksh 15 billion. The growth of the deposits will result from Ndara B Community Material plan savings; DUT workers savings; DUT workers’ pay applied toward mortgage repayment either through rent or property ownership, and, MSMEs budgets applied to completed property usage.

Why should a bank join you?

Every bank that opens has a primary goal of growing deposits. The second goal is to issue loans. The DUT system by Diaspora Kenyans and Ndara B Community can grow the deposits of any bank by Ksh 50 billion. The DUT system further creates loan products of about Ksh 44.5 billion. The loans once issued can generate interest revenue of about Ksh 8 billion. The $500 million can earn forex exchange income of over Ksh 2 billion. This is a Ksh 10 billion bank revenue opportunity.

Dan Kamau can be reached via Email dan@dut.or.ke

Visit our website www.dut.or.ke